Customer Experience Trends

A large global bank had aggressive growth plans to expand their international commercial client network, but the manual and complex onboarding process was hindering growth. It took the bank 40 to 90 days to set up new accounts and services for both domestic and international clients. The bank implemented a global transformation of their onboarding process, making it digital and eliminating weeks of onboarding time. This made the process seamless across customer-facing channels and provided real-time analytics. The transformation helped the bank achieve its growth targets for the commercial client network.

Another payments player aimed to enhance its customer dispute resolution process and was considering upgrading its technology to reduce processing time. After seeking customer feedback and conducting interviews, they discovered that the main issue was not processing time, but the lack of status updates provided to customers. By understanding the real problem, the bank was able to solve it with less effort and a higher chance of success in improving customer experience.

Both examples highlight the importance of investing in customer experience transformation. Customer experience (CX) has become the key competitive differentiator in the banking industry today. Statistics show that financial institutions that prioritize customer experience have reported higher rates of recommendation, greater wallet share, increase in retention, and increase in the ability to up-sell or cross-sell products and services to existing customers.

The top trends reshaping Customer Experience in Banking evolves around 5 themes.

1) Personalization and hyper-personalization through data.

2) Minimizing consumer effort through embedded Banking

3) “Humanizing” digital to personalize at scale with AI.

4) Doing the right thing for your customers and the bank.

5) Digitization and automation facilitating convenience and efficiency.

Key Challenges in Customer Onboarding Transformation

Banks often lack a customer and employee friendly customer journey process. Some of the key challenges faced by banks as they look to transform their onboarding journey are as follows:

- Manual Process: The onboarding process is entirely manual, semi-manual and inconsistent.

- Operational Inefficiency: The onboarding process is operationally inefficient, putting a massive burden on staff.

- Inconsistent Customer Experience: Customer experience across different products and devices is inconsistent and confusing. Often customers end up inputting the same information repeatedly across different touchpoints.

- Data Inconsistency: Data propagation across SORs encounters several issues due to inconsistencies in data types and field length.

How Infosys Consulting Helps Envision the To Be Process

Infosys Consulting helps clients envision and implement a target state that is hyper personalized, secure, consistent and convenient.

- Hyper-Personalization: Focus on leveraging information and data provided by customers already, using data analytics to give a personalized experience to customers.

- Security: Focus on delivering highly secure public portal access to customers, ensuring the safety of their personal information shared during the onboarding process.

- Consistent: Focus on leveraging the latest UX technology to provide a consistent experience to customer across devices and browsers.

- Convenient: Focus on design thinking principles to make the customer journey frictionless and convenient.

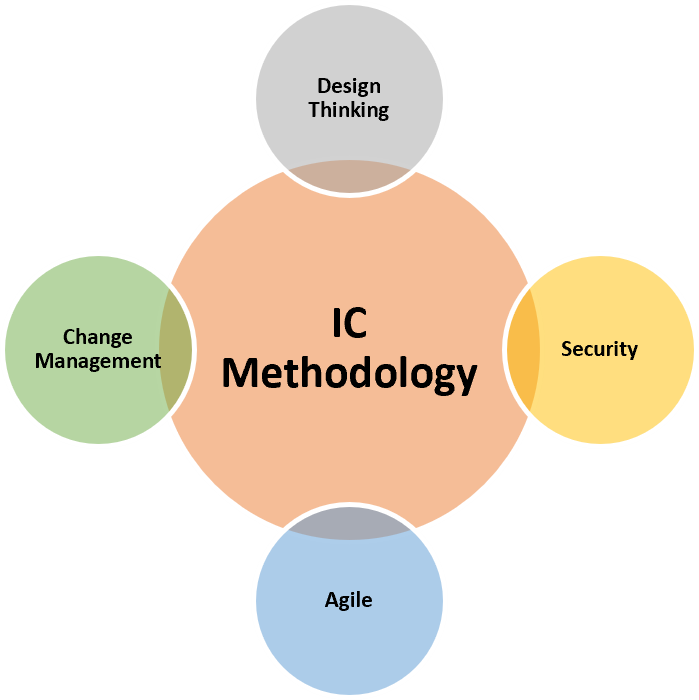

Infosys Consulting (IC) Methodology for Customer Onboarding Transformation

Infosys Consulting (IC) focuses on a comprehensive approach covering elements of strategy to execution to help customers on their Customer Onboarding transformation journeys. IC’s unique methodology uses levers of Design thinking, Security, Agile Product Mindset and Change Management to deliver effective Customer Journey transformation programs.

Leveraging Design Thinking

While reimagining the customer journey IC focusses immensely on design thinking methodology and leverages the specific tools and methodologies employed in design thinking.

The key starting point for the design thinking process is focusing on creating an Empathy map which focuses on answering some key questions such as:

Who are we empathizing with?

- What do they hear?

- What do they do?

- What do they need to do?

- What do they see?

- What are they think and feel?

The next focus area is to create a customer persona, analyzing customer pains and gains, their goals and aspirations. Design thinking further builds on this by doing a STEEP trend analysis, which focuses on socio-cultural, technological, economic, environmental and political trends relevant to customer organizations.

After conducting an As-Is analysis by leveraging the above tools and steps, the next set of actions focuses on defining the CX vision, creating an adcept, prototyping the CX solution and building a measurable approach to monitor the effectiveness of the CX vision. The Design Thinking aspect of the solutioning approach focuses on making the To-Be customer onboarding process intuitive and frictionless.

Security and Authentication

Customer journeys particularly through portals accessible through internet are susceptible to major security threats. The increasing level of sophistication from hackers makes customer journeys vulnerable for customers who are at risk of Identity theft, DDoS attacks as well as financial frauds. IC focuses on sound security and design principles while redesigning customer journeys. Some of the common themes that are addressed are as follows:

- Leveraging tools to prevent DDoS and WAF attacks

The traffic from the internet is susceptible to various vulnerability attacks. It is critical to protect the customer journey at various touchpoints, right from where the customer starts inputting the data to that data going through the integration layers and eventually reaching the SORs. WAF and DDoS protection leveraging industry standard tools and as suited to the customer’s specific needs should be leveraged at the various touch-points of customer data input and flow journey, at the onset of data input using the public portal by having the traffic pass through the DDOS and WAF tool first, at the onset of the integration layer , where the handoff of the data happens from Portal to Integration later by having tools such as Azure Appgateway etc.

- Virus Scan tool

As part of the customer Journey, customers have to upload a lot of documents depending on the product for which they are starting the customer journey. It is critical therefore that those documents are scanned for viruses using an appropriate virus scanning tool.

- Use of ReCAPTCHA

An additional layer of protection for DDoS attacks can be provided by adding captcha to the Portal pages. The latest version of ReCAPTCHA provided by vendors provide a frictionless experience while managing the security aspects.

- Leveraging Appropriate Authentication Mechanism

Customer journeys should be authenticated using strong and appropriate authentication mechanisms. The choice of authentication method could depend on the specific touchpoint of the customer journey where authentication is required. For customer facing portal a user ID/password enhanced by MFA may be the most appropriate method, while for a customer visiting the branch, a card and pin validation may work better. IC collaborates with the clients in designing these authentication methods as well as helping them decide which authentication method should be applied to which part of the customer journey to make the journey frictionless for customers. The typical authentication methods leveraged are as follows:

-

- Something that user know: This pertains to the use of passwords, and this method is the weakest as it can be easily compromised. There have been instances where the user has set up a strong password but to remember it, they wrote it on a yellow sticky and stuck it on their monitors.

- Something that user has: This can be an ID or token that the user has. For example, the RSA token ID, smart cards, debit card and pin (2-factor authentication).

- Something that user is: This is the most secure and most expensive as well. In this method the user biometrics like the face, fingerprint, iris scan etc. are considered to authenticate.

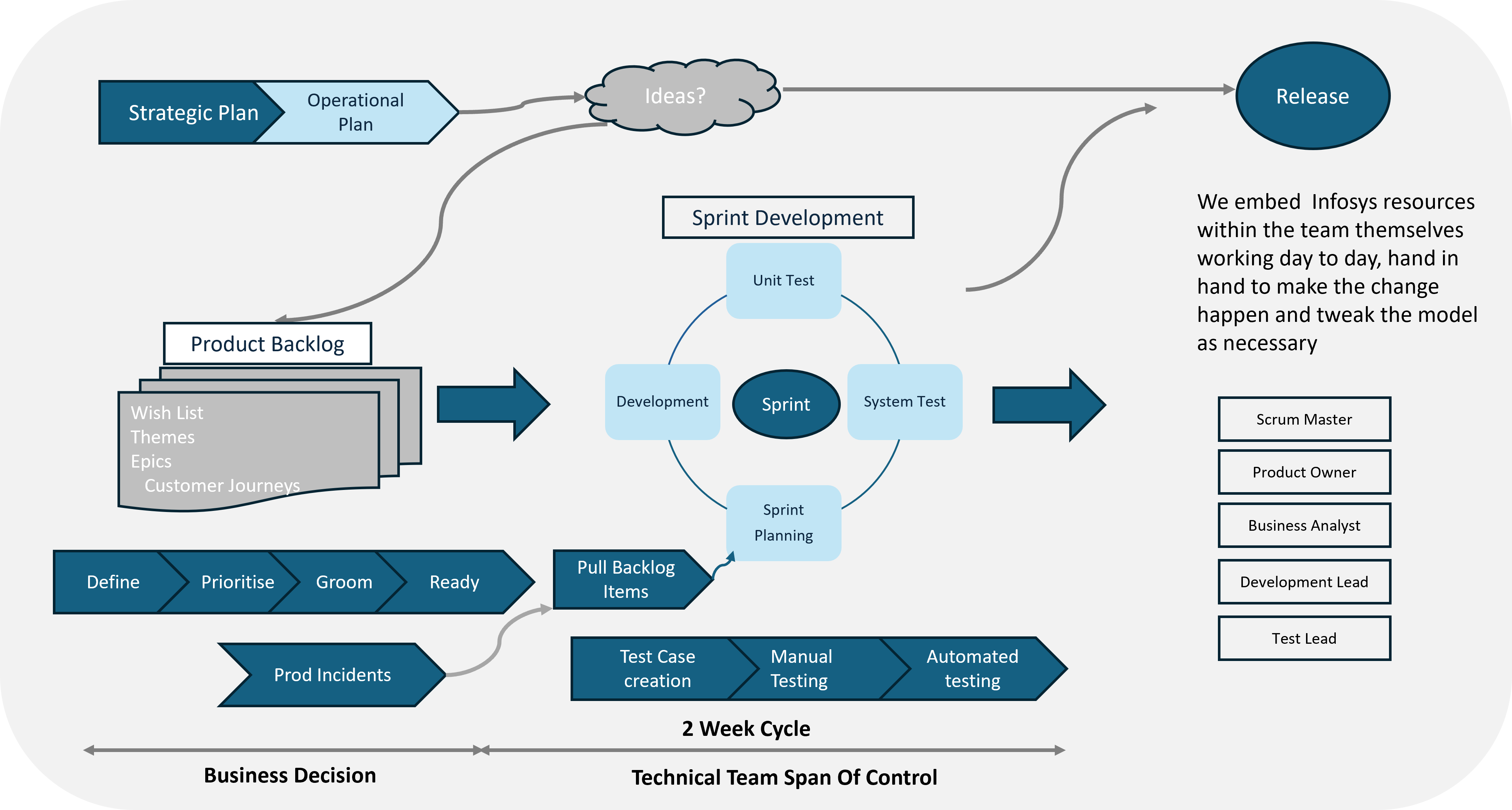

Agile Methodology

Customer journeys need to be built and refined using an iterative approach. It is critical to think of the journey from an Agile product mindset and have an MVP developed which can be further refined and made sophisticated through the active inputs of business, design, solution architects and the tech team. IC leverages a well-established and highly evolved agile methodology while delivering Customer Journey transformation programs.

Change Management Approach

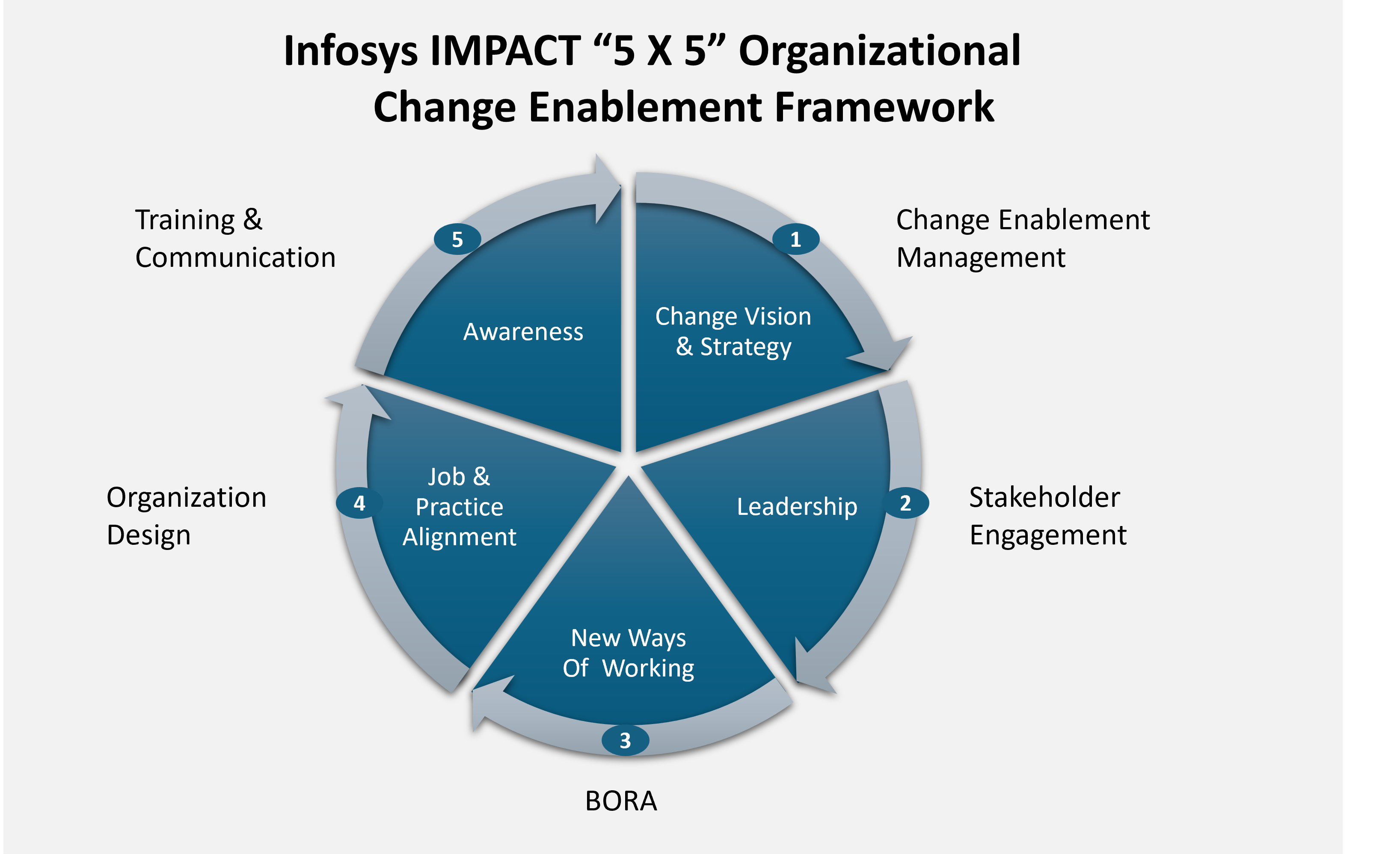

Any successful transformation program requires an effective change management approach for it to be successful. IC leverages a robust Change Enablement framework to ensure that the change is effectively executed. The framework encapsulates key elements such as defining a clear Vision and Strategy for the Change, effective Stakeholder involvement, defining new ways of working, effective Organization design and emphasis on Training and communication.

Case study

IC worked with a large bank in the Philippines to deliver a significant transformation for their customer onboarding process. Leveraging effective frameworks, IC helped transition the bank from a completely manual, unstructured onboarding process to a sophisticated, frictionless system for products such as CASA and loans. The project utilized design thinking principles to redesign the customer journey and agile methodology to deliver iterative releases of the Customer Journey Program, progressively adding new features and products. IC successfully delivered the program in collaboration with the experienced service delivery teams of Infosys D365 and Azure.

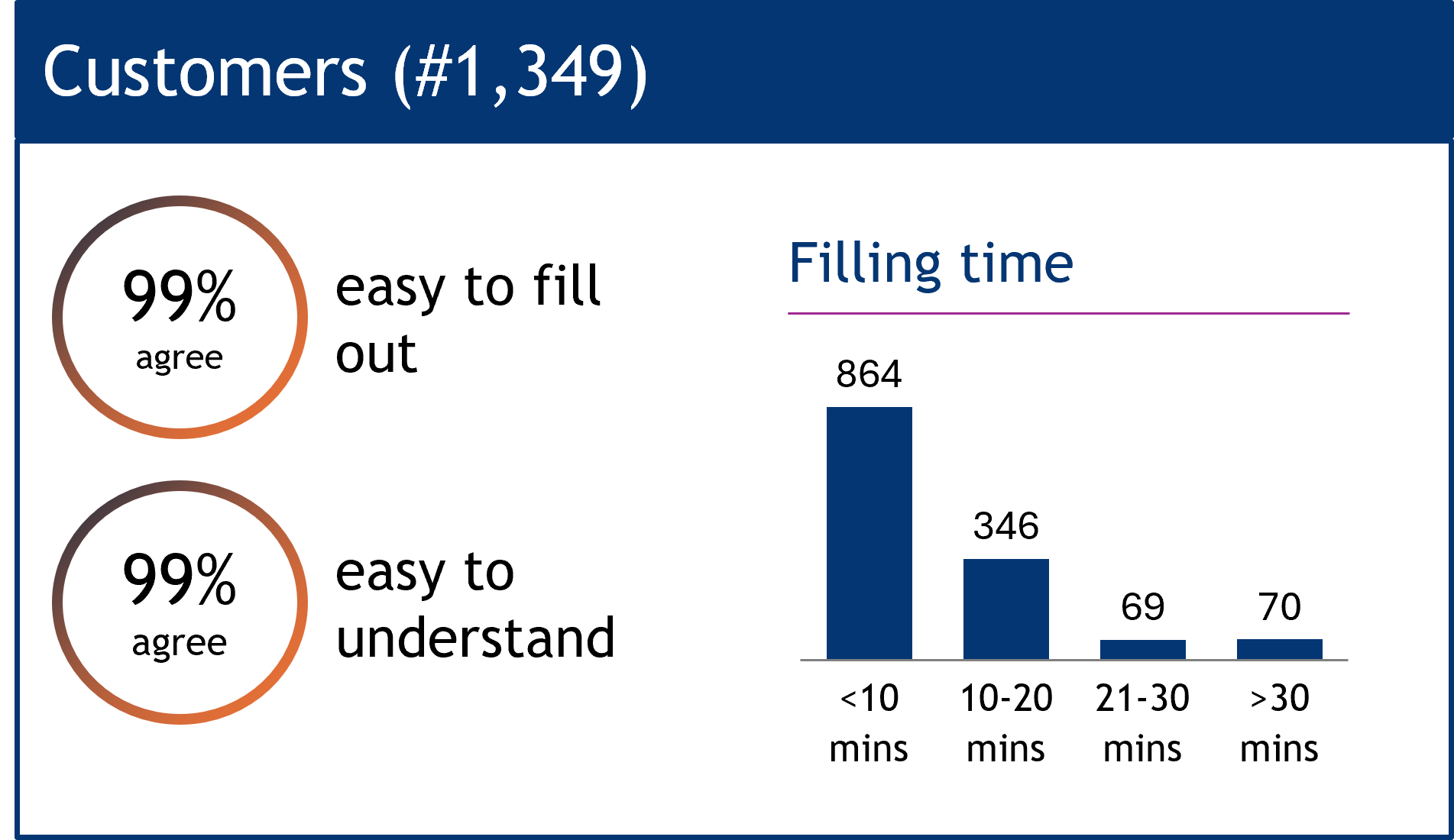

Moving from a traditional offline onboarding process, the client has experienced a substantial increase in the usage of their online onboarding portal. A customer satisfaction survey revealed prominent levels of satisfaction among bank customers, as shown in the results below:

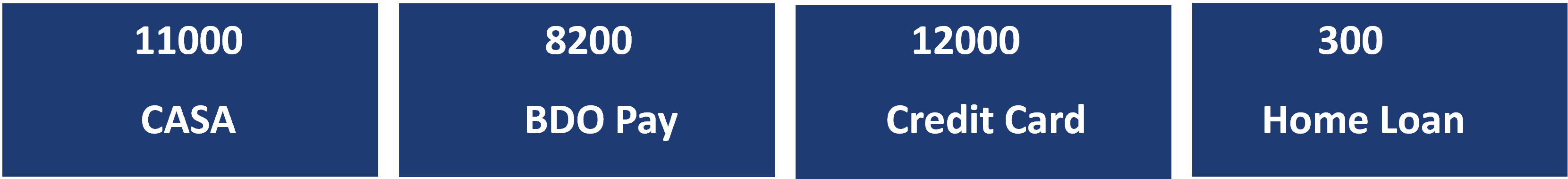

Additionally, the onboarding platform implemented by IC has become a significant source of new customer acquisition for BDO and has contributed to operational efficiency. The numbers below illustrate the number of applications initiated on the platform per day for the products launched on the new onboarding platform.

References

What is Customer Experience? Definition, Challenges, Importance

12 Banking Customer Experience Trends to Watch in 2023

HSBC: Digital transformation of global business onboarding | FST Media