Abstract

Financial institutions are facing a ‘relevance revolution’ where generic services no longer meet the demands of today’s customers. This paper explores the challenges of legacy systems, data silos, and the imperative to extract meaningful insights from the data deluge. Hyper-personalization emerges as a key differentiator, leveraging AI, machine learning, and even “synthetic customers” to understand individual needs and preferences. By embracing a data-driven approach, financial institutions can break down data silos, predict customer behavior, and deliver tailored experiences that foster engagement, loyalty, and sustainable growth. Infosys Consulting offers the expertise and solutions to guide this transformation, ensuring financial institutions thrive in the age of hyper-personalization.

The Relevance Revolution – A Changing Landscape

Global financial institutions are awash with data. Yet many of them struggle to truly connect with their customers. In today’s environment, they are facing a relevance revolution, where generic products and one-size-fits-all marketing approach are driving customers away. This disconnect is not just a missed opportunity, it is a threat to growth and survival in an increasingly competitive landscape. Legacy systems, siloed data, and the sheer volume of information create a perfect storm, leaving institutions struggling to answer critical questions:

- How well do we truly understand our customers’ individual needs and financial goals?

- Are we leveraging data effectively to anticipate customer needs and personalize offerings?

- Can our current capabilities and infrastructure handle the demands of delivering hyper-personalized experiences at scale?

- Are we missing out on opportunities to deepen customer relationships and drive loyalty?

- How can we turn data into actionable insights that drive business growth and customer satisfaction?

Without answers to these fundamental questions, institutions risk missing out on substantial opportunities to cultivate stronger customer relationships, optimize revenue streams, and deliver the highly personalized experiences that drive customer satisfaction.

Drowning in Data, Thirsting for Insights

Financial institutions today face a paradox – while they have ready and quick access to customers’ data, most struggle to truly understand their customers. Today, there exists the capabilities to tap into newer sources of data and capturing every interaction across multiple channels used by customers. This “data deluge” often obscures meaningful insights, hindering their ability to deliver personalized experiences. To navigate this complex landscape, business leaders must address three critical grey areas –

-

- First, they must conquer the data labyrinth. Data often resides in silos across departments, creating a fragmented view of the customer. Firms need to ask themselves – how can we break down these data silos to create a 360-degree view of each customer? This requires not just technological solutions, but also a shift in organizational structure and data governance to ensure data is shared and utilized effectively.

- Second, institutions need to master the ability to uncover true insights. Deriving true insights from considerable amount of data demands usage of right tools and techniques (AI, machine learning, data science) and deep expertise, to uncover hidden patterns in customer behavior and translate such insight into actionable strategies.

- Finally, financial institutions must bridge the gap from insight to action. Even the most brilliant insights are meaningless if they don’t translate into tangible improvements. How can we effectively integrate these insights into our customer journeys, product development, and marketing efforts? This requires operationalizing personalization, embedding data-driven decision-making into every customer interaction, and ensuring that insights determine every aspect of the customer experience.

Fig 1 – Unclear insights have significant impacts on a financial institution’s ability to serve its customers effectively.

Failing to address these key areas leaves institutions at a significant disadvantage.

Further, in this data-driven world, financial institutions burdened by data silos and outdated technology are at a significant disadvantage. They risk falling behind competitors who can leverage customer insights to deliver hyper-personalized experiences and drive superior value.

Hyper-Personalization – The Key to Customer Loyalty

Driven by customer expectations, hyper-personalization is a key area of focus across industries. In a global financial institutions survey conducted by Boston Consulting Group, it was revealed that 70% of the firms surveyed stated that personalization is a clear visible priority for the company and its overall digital strategy. However, only 15% rate their personalization capabilities as above basic level2.

So, what exactly is hyper-personalization? It’s the art and science of tailoring financial products, services, and marketing messages to the specific needs and preferences of each individual customer. Imagine a world where your bank proactively recommends investment opportunities aligned with your risk tolerance and financial goals. Or picture receiving a personalized loan offer tailored to your credit history and upcoming life events. This is the power of hyper-personalization in action.

Examples of Hyper-Personalization in the world of financial services –

- Personalized Financial Advice – Leveraging AI to provide tailored investment recommendations based on individual risk tolerance and financial goals.

- Proactive Customer Service – Anticipating customer needs and offering proactive support through personalized alerts and notifications.

- Tailored Product Offers – Offering personalized loan or credit card offers based on individual financial profiles and spending habits.

- Personalized Onboarding – Creating a seamless and tailored onboarding experience for new customers based on their specific needs and preferences.

Fig 2 – The benefits for financial institutions are undeniable

In today’s competitive financial landscape, the ability to leverage customer data and deliver hyper-personalized experiences is no longer a luxury, it’s a necessity.

Bridging the Gap from Data to Hyper-Personalization in Financial Services

The challenges across data labyrinth, ability to uncover true insights, and the gap between insight and action, demand a holistic approach underpinned by a well thought out hyper-personalization framework.

1. Conquering the Data Labyrinth with Unified Customer Profiles –

Hyper-personalization begins with creating the right data ecosystem. Tapping all data sources (both internal and external) across multiple channels of customer interaction, breaking down data silos and eventually creating a unified, 360-degree view of each customer, is a fundamental requirement. This involves implementing robust data integration solutions that connect disparate data sources across the organization and beyond. Beyond technology, it requires establishing clear data governance frameworks and fostering a culture of data sharing. By creating a single source of truth for customer data, institutions can gain a holistic understanding of individual needs, preferences, and behaviors. This unified profile forms the foundation for all subsequent personalization efforts.

2. Mastering in Deriving Insight with Advanced Analytics –

With a unified customer profile in place, the next step is deriving meaningful insights. Hyper-personalization leverages the power of AI, machine learning, and advanced analytics including GraphDB, to not only uncover hidden patterns and trends within customer data but also to simulate customer behavior through the creation of “synthetic customers.” These AI-powered representations mimic how real customers think, behave, and make choices, allowing institutions to test and refine personalization strategies in a risk-free environment. This goes beyond basic reporting and delves into predictive analytics, enabling institutions to anticipate customer needs and proactively offer relevant solutions. By employing data scientists and investing in robust analytics platforms, institutions can transform raw data into actionable intelligence and gain a deeper understanding of individual customer preferences and motivations.

3. Bridging the Gap from Insights to Actions with Operationalized Personalization –

The true power of hyper-personalization lies in its ability to translate insights into tangible improvements in the customer experience. This requires operationalizing personalization by embedding data-driven decision-making into every customer interaction. This would involve integrating insights into product development and marketing campaigns, re-designing customer journeys to tailor interactions at key moments and touchpoints and embedding personalized recommendations for customers across all interaction touchpoints.

A Framework for Hyper-Personalization

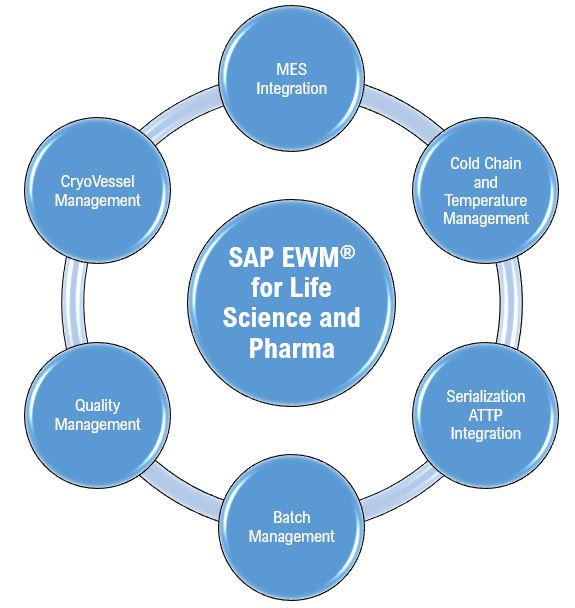

To address these challenges, financial institutions may adopt a following framework as suggested below:

Fig 3 – A Framework for Hyper-Personalization

With evolving customer expectations for personalized connected experiences coupled with their growing willingness to provide consent to share data, it is imperative that financial firms adopt hyper-personalization as a strategy to deliver exceptional customer experiences. Adopting a robust framework that focuses on establishing the right data ecosystem, uncovering timely insights and translating the insights into actions through an optimal operating structure, will help financial institutions stay ahead in their game.

Infosys Consulting – Your Hyper-Personalization Partner

Infosys Consulting helps global corporations – in over 20 countries – to develop unique solutions that address their complex business challenges and create value through sustainable innovation.

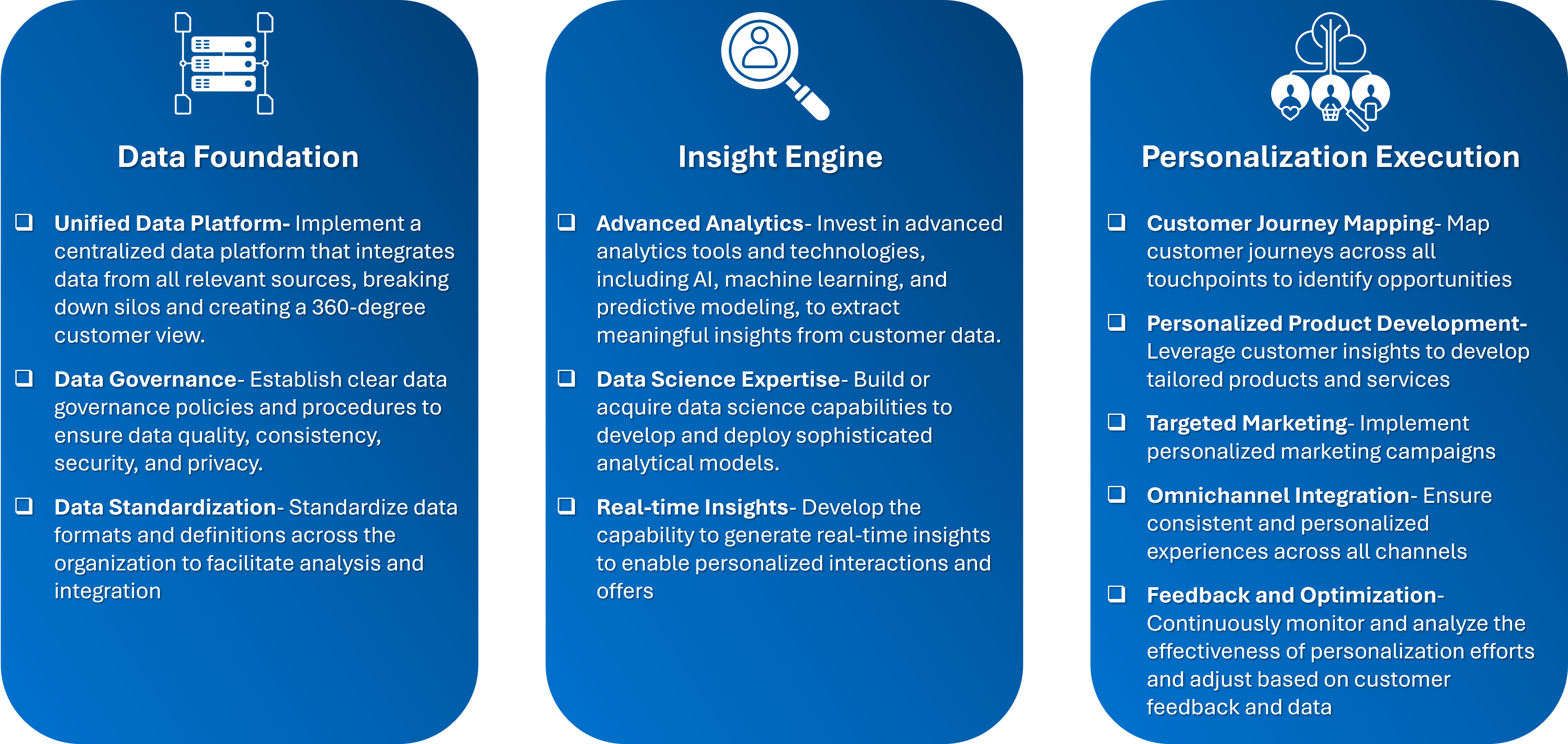

Our structured approach and industry-proven accelerators help our clients achieve their strategic goals. We bring a wealth of experience and expertise to help financial institutions navigate the complexities of hyper-personalization. We offer a comprehensive suite of solutions and services designed to empower you on this journey.

Fig 4 – Our Transformative Approach for Hyper-Personalization

Partnering with you in your hyper-personalization journey –

1. Understanding your customers’ needs and expectations – We adopt a human-centered approach, leveraging design thinking and customer research to deeply understand your customers’ expectations and pain points regarding personalized experiences.

2. Developing a data-driven personalization strategy – We help you define a clear vision and roadmap for hyper-personalization, aligned with your business goals and customer needs.

3. Building a robust data foundation – We assist in establishing a unified customer view by breaking down data silos, implementing data governance frameworks, and leveraging cutting-edge data management platforms.

4. Extracting actionable insights – We employ advanced analytics, AI, and machine learning to uncover hidden patterns in customer data and translate them into actionable strategies.

5. Designing personalized customer journeys – We help you design and optimize customer journeys across all touchpoints, ensuring a seamless and personalized experience for your customers.

6. Implementing and integrating hyper-personalization solutions – We guide you through the selection and implementation of appropriate technologies and solutions, ensuring seamless integration with your existing systems.

7. Measuring and optimizing performance – We help you establish metrics and track the performance of your hyper-personalization initiatives, enabling continuous improvement and optimization.

References