In the age of big data and machine learning, managing your finances isn’t just about spreadsheets and willpower. It’s about harnessing the power of Artificial Intelligence (AI) to achieve optimal performance. What if you had a trusty AI companion, a financial Gandalf the Grey guiding you towards optimal performance with the power of machine learning and computational magic?

Data Demystification: AI Unveils the Hidden Patterns

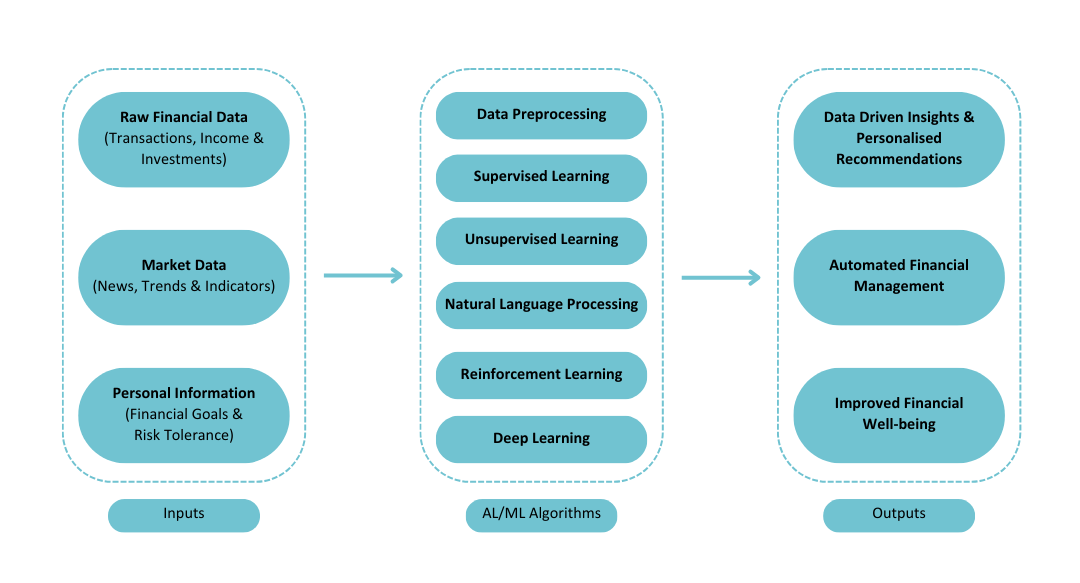

Gone are the days of manually categorising transactions and deciphering cryptic bank statements. AI-powered tools leverage Natural Language Processing (NLP) to understand your spending habits, and automatically classify transactions with supervised learning algorithms like Naive Bayes or Support Vector Machines. Imagine a neural network analysing your financial landscape, highlighting anomalies with Local Outlier Factor (LOF) models, and revealing hidden patterns invisible to the human eye. This transparency empowers you to make informed decisions and not impulsive splurges.

Budgeting on Autopilot: AI Learns Your Habits, Optimises Your Plan

Remember the constant struggle to stick to a budget? AI steps in as your budgeting buddy, automating expense tracking and suggesting personalized spending plans. Dynamic Time Warping (DTW) algorithms analyse your past spending patterns, understanding your unique financial rhythm. Think of it as a self-driving budget car, navigating financial bumps with reinforcement learning, where algorithms like Q-Learning continuously adapt your budget based on your spending behaviour and goals, constantly learning and optimizing your financial path.

Debt Demolition: AI as Your Algorithmic Exterminator

Debt can be a major roadblock to achieving your goals. AI comes armed with powerful debt-slaying algorithms, analysing your loans and suggesting optimal repayment strategies using Genetic Algorithms. These algorithms simulate natural selection, iteratively generating and evaluating different repayment plans to find the most efficient one, eliminating high-interest options first.

Investment Savvy: AI Scans the Market, Predicts Future Trends

The stock market can be daunting. But AI, armed with vast data and complex algorithms, can unveil market trends and identify promising investment opportunities. Deep learning models like Long Short-Term Memory (LSTM) networks analyse historical data and financial news sentiment to predict future market movements, while NLP scans financial news to extract relevant insights. Remember, AI is not a magic wand, but a powerful tool to inform your investment decisions and potentially boost your return.

Human touch is still needed

While AI offers immense benefits, it’s crucial to remember that it’s a tool, not a replacement for your financial acumen. AI thrives on your input and guidance, so set clear goals, define your risk tolerance, and actively engage with the insights it provides. Think of AI as your financial co-pilot, working alongside you to chart a course towards financial freedom.

As AI continues to evolve, its role in personal finance will become even more profound. Imagine AI-powered chatbots offering personalised financial advice based on NLP and sentiment analysis, or algorithms automatically adjusting your investments in real-time based on market predictions from deep learning models. While the future remains unwritten, one thing is certain: embracing the power of AI can empower you to achieve optimal financial performance and unlock your true financial potential.

With AI as your co-pilot, you can navigate the financial labyrinth with confidence, leaving the gremlins behind and achieving true financial Zen.