“Risk comes from not knowing what you are doing” – Warren Buffet

The digital revolution in businesses has created data in abundance, and our ability to interconnect data and drive insights to support decisions with speed also has seen a phenomenal jump. Incidentally, it also added an element of risk to the overall business operations with regard to Fraudulent transactions, unauthorized access, and cyber threats.

Managing Risk in an organization is now an integral facet of the CFO’s work. From overall business financial compliance to the IT teams, CFO now forms the most critical line of defense in establishing and maintaining adequate risk and policy controls in today’s digital organization.

Here are some of the best practices CFOs must adopt to enable a future-ready risk-averse organization

1. Avoid Process Silos: According to a survey 86%, [1] of companies still use spreadsheets to manage financial and operational risks like fraud, errors, business policy violations and compliance irregularities. Build an integrated process framework for Audit, Compliance and Risk that allows finance and compliance staff to perform risk management and internal controls activities with an oversite to business operations. Organizations having built an integrated operational risk framework can now shift focus from managing and mitigating each risk in isolation to assessing organizations’ collective exposure to the risk.

2. Build Risk Champions: Integrated Risk management helps promote Risk Intelligent Culture by providing a unified enterprise-wide view of risk within the organization. Identify a team of highly motivated audit members who can detect security issues proactively, preventing delays that might lead to larger disruptions. Additionally, equip the members with advance tools and technology to support not only identification of risks but also timely mitigations. Lastly, define a policy for periodic review of the organizations risk exposure and effectiveness of mitigation techniques along with understanding industry trends to stay relevant.

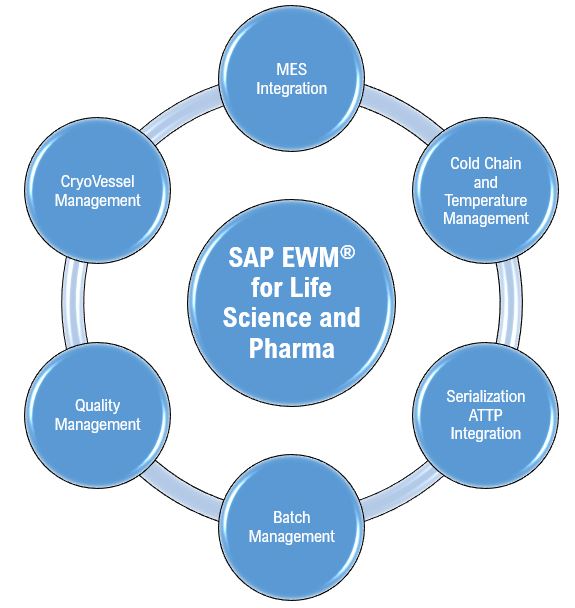

3. Digitize Risk: Risk management should be an integral part of any business’s digital adoption journey. Make risk and prioritization, Risk Response and Mitigation, Risk Monitoring and Reporting key process parameter for business application software selection. Enable a coherent working platform between internal and external audit teams which is intuitive, and self-service driven. Having a unified platform will reduce the cycle time between internal and external audit teams, driving efficiency in managing risk. Utilize next gen predictive technologies like Machine Learning (ML) and Artificial intelligence (AI) to identify and automate risk monitoring and detection.

4. Be Proactive: Cognitive computing with deep analytics and Machine learning can automatically analyze patterns of anomalies and report risk and potentials which might be overlooked by a human mind. In the current data intensive world, risk management is a perfect case for implementations of data learning algorithms to generate insights to proactively identify risk and minimize the impact of the same. Risk platforms with built-in AI can continuously monitor business process to detect and prevent operational risk.

Finance as a Service framework by Infosys defines Finance Transformation as an Enablement of the CFO’s Perpetuity journey towards Target Operating Model (TOM) via People, Process, Technology, Data & Governance leading to maximization of Value-Add for the CFO’s customers. Critically it embodies these best practices for Risk and Compliance as part of the overall framework. FaaS framework aims at future state of risk function to be Automated, Connected, Predictive and Workflow Driven.

Let me know your thoughts by answering in comments section: Is Digital Risk Management a necessity?

[1] Oracle Blog: https://blogs.oracle.com/modernfinance/post/how-to-use-data-science-and-machine-learning-to-reduce-risk