Credit checks are an essential part of any business transaction including an organization shipping product.

This article gives a perspective and key considerations for a business dealing with B2B and B2C orders.

✓ The traditional industry trend for credit checks at the time of order placement (order booking) for

both B2B and B2C customers. This approach allows the business to identify any potential credit

risks early in the process such as customers with poor credit history, high-risk industries, or

suspicious activities.

✓ New trend of conducting additional credit check before actual shipping, business can reduce the

risk of non-payment, fraud, or other financial losses, and adjust payment terms or credit lines

accordingly. It also enables business to establish a strong business relationship based on trust and

transparency.

✓ Additionally, advancements in technology have made it easier to conduct credit checks quickly

and efficiently, using various data sources such as credit bureaus, payment histories, and financial

statements. This has enabled business to make informed decisions based on accurate and up-todate information.

✓ Overall, conducting credit checks before shipping has become an industry standard practice for

most businesses, and it’s essential to maintain a healthy balance between risk management and

customer satisfaction.

Order Changes Perspective:

B2B:

✓ Contractual obligations: Customers often have contractual obligations, such as supply agreements or service level agreements (SLAs), that require specific ship dates. Changes to the ship date may require renegotiating the terms of the contract, which can be time-consuming and costly.

✓ Large orders: Customers may place larger orders, which may require longer lead times for production, shipping, and delivery. Changes to the ship date may have a significant impact on the production schedule, leading to delays or increased costs

✓ Customer relationship management: Customers often have longer-term relationships with the business, and changes to the ship date may impact the overall customer experience and satisfaction. Effective communication and collaboration are essential to managing these changes effectively

B2C:

✓Consumer expectations: Customers expect fast and reliable shipping, and changes to the ship date may impact their perception of the brand and their overall satisfaction. Effective communication and transparency are critical to managing these changes effectively.

✓Small orders: Customers may place smaller orders, which may require shorter lead times for production, shipping, and delivery. Changes to the ship date may have a limited impact on the production schedule, but it may still impact the overall customer experience

✓Fulfillment options: Customers may have different fulfillment options, such as in-store pickup or same-day delivery, which may impact the ship date. Effective coordination and management of these options are essential to manage ship changes effectively

In summary, credit checks for B2C customers may focus on limited information, inconsistent payments, fraudulent activity, and consumer protection laws, while B2B credit checks may deal with complex credit histories, large credit lines, industry-specific risks, and legal and regulatory compliance

Key challenges doing credit check during shipping:

Conducting a credit check during shipping can present several challenges for businesses like

✓Shipping Delays: Conducting a credit check during shipping can lead to delays in the shipping process, which can result in customer dissatisfaction, additional costs, and lost revenue. If the credit check indicates a potential risk, the business may need to hold the shipment until payment is received or renegotiate payment terms with the customer.

✓Legal Issues: Conducting a credit check during shipping can raise legal issues related to privacy and data protection. Business need to ensure that they comply with local and international regulations, such as the General Data Protection Regulation (GDPR), when collecting and processing customer data.

✓Customer Relationship Management: Conducting a credit check during shipping can impact the customer relationship and may result in negative feedback or loss of business. It’s essential to communicate effectively with customers about the reasons for the credit check and the potential impact on the shipping process.

✓Inaccurate Information: Conducting a credit check during shipping can result in inaccurate information due to delays or inconsistencies in data sources. This can lead to incorrect decisions regarding payment terms or credit limits, which can impact the business financial performance.

In summary, conducting a credit check during shipping can lead to delays, legal issues, impact customer relationships, and result in inaccurate information. To mitigate these challenges, it’s important to communicate effectively with customers, comply with regulations, and use reliable data sources to ensure accurate decision-making.

Conclusion:

B2B:

Conducting a credit check during the order book stage can help to identify any credit risks and potential defaults early in the process. This can help the business to mitigate the risks by adjusting payment terms, credit lines, or even canceling the order if necessary. It can also help to establish a strong business relationship based on trust and transparency. However, if the credit check is conducted at the time of shipment, it can lead to delays or disruptions in the supply chain, resulting in customer dissatisfaction, increased costs, and potential legal or financial issues

B2C:

Conducting a credit check during the order book stage may not be as critical for B2C customers due to the lower credit limits and smaller orders. However, it is still essential to conduct credit checks at the time of shipment to prevent fraud and protect the business interests. It can also help to manage customer expectations, maintain brand perception, and ensure timely delivery. However, if the credit check is conducted too early, it may lead to canceled orders or delays in processing, which can negatively impact the customer experience

In conclusion, the timing of credit checks can vary depending on the type of customer, the order size, and the nature of the business. It is essential to find the right balance between risk management and customer satisfaction to maintain a successful business relationship

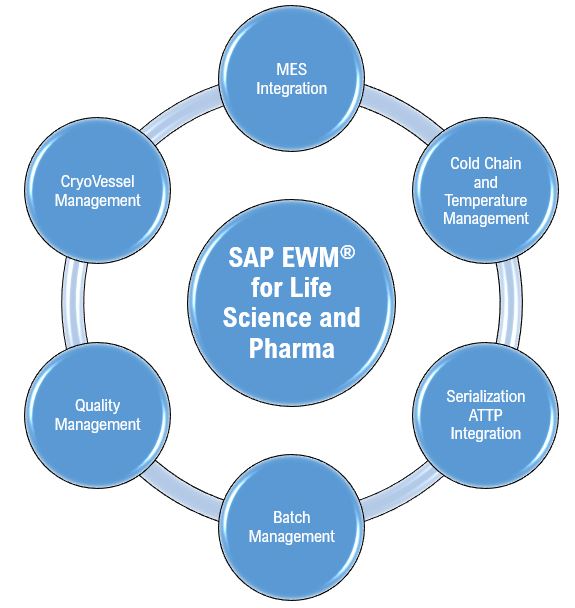

Infosys Oracle Cloud Solution Case study:

✓This process involves evaluating a customer’s creditworthiness by examining their financial history and current credit status and determining whether they are capable of paying for their shipments. By performing a credit check based on shipment schedule, businesses can make informed decisions on whether to approve or decline a shipment and ensure that their cash flow remains healthy

✓Oracle provides advanced tools and capabilities for automating and streamlining the credit check process, including real-time credit risk assessment, credit scoring, and credit limit management. These tools allow organizations to make quick and informed decisions, reducing the time and effort required to perform a credit check manually.

✓Moreover, credit check based on shipment schedule in Oracle allows businesses to prioritize their shipments, ensuring that they are processed in a timely and efficient manner. This helps organizations to meet their customers’ expectations and maintain their reputation as a reliable and trustworthy business partner.

✓Overall, credit check based on shipment schedule in Oracle provides businesses with a powerful tool to manage their financial stability, reduce risk, and make informed decisions that positively impact their bottom line. By incorporating this process into their operations, organizations can take the first step towards a successful and secure shipping process.