With the definite change from defined-benefit pension plan[1] to defined-contribution plan in corporate America and the shifting demographics across the world in client segments[2], Wealth managers may soon transform into “life managers” as preference for self-educated investments, hybrid[3] communication channels and access to exotic products and niche solutions increases. The gamut of advice they offer will expand as clients expect their advisors to provide holistic financial advice with an inventory of solutions that includes insurance, health, lifestyle choices among other things.

Advisors, therefore, need to be well-versed in hitherto unexplored areas of advice. For example, if a client wants to relocate to a new city post-retirement due to its tax advantages, advisors can improve the quality of decision making by providing inputs on additional factors such as climate change (cost of insurance, loss of property due to storms) and healthcare, which would help their clients compare their choices more objectively.

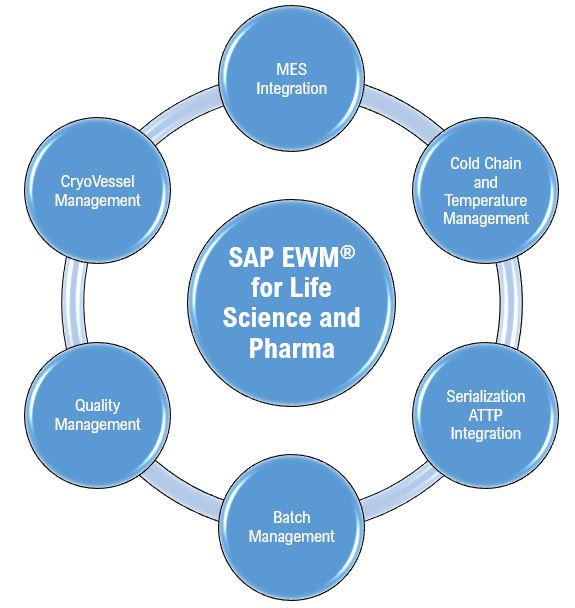

Evolving paradigms and becoming AI-first

While the role of Advisors change, the nature of advice and the extent of their involvement will vary depending on the client segment and AUM of portfolios. What was once a concierge and white glove service is now mainstream as firms have started expanding their services from ultra-high net worth individuals / high net worth individuals to mass affluent clients. The new clientele demands a similar level of access to efficient advisors who can provide solutions catering to specific life-events and situations of the clients. This is also a segment that is higher in number, thereby, increasing the advisor to client ratio. Hence, Advisors need to find ways to increase their bandwidth, become more intuitive and understand such clients at a much deeper level.

Figure 1 : Evolving paradigms in Wealth Management

Technology, data, and analytics remain the key in this changing business model. A financial advisor could soon be leading a team of “AI colleagues” who will be helping him/her provide better client experience, manage portfolios, improve operational efficiency, and boost productivity as bionic[4] advisors are fast becoming a reality. We will soon arrive at a new 80-20 paradigm in which 80% of the tasks are performed by cognitive AI colleagues, leaving the advisors to focus on the 20% that are high-touch, and which adds real value to the client.

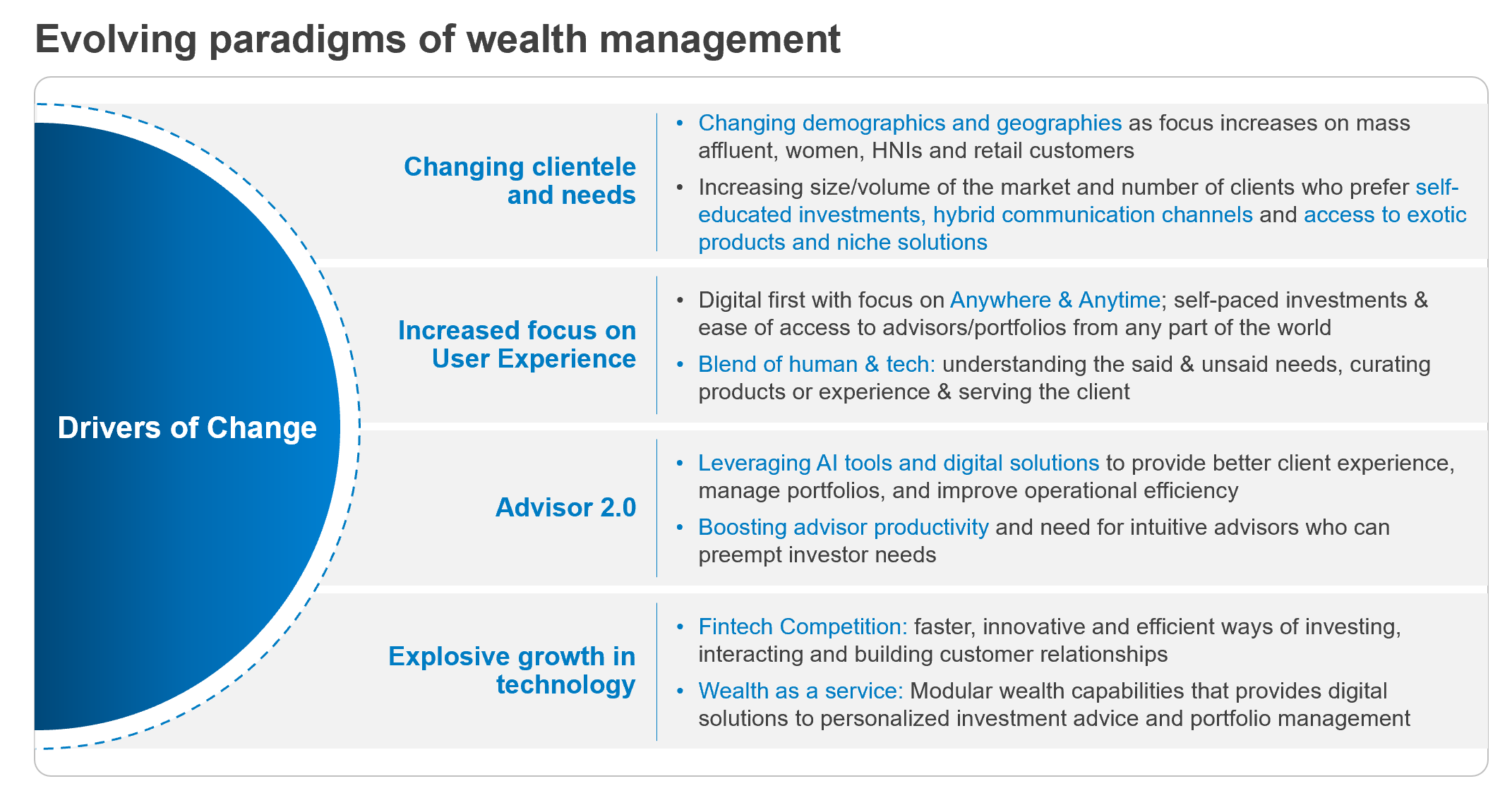

Figure 2 : AI-first Wealth Management

Wealth management firms need to reorient themselves and become AI-first. An AI-first enterprise will have AI at the core of its business strategy. It is about transforming into a Live enterprise that amplifies human potential, improves client service, reimagines business processes and software engineering, and boosts productivity. An AI-first enterprise provides hyper personalized user experience, encourages humans and machines to co-exist, and exploit data (or the lack of) in an innovative and responsible ecosystem.

Being AI-first

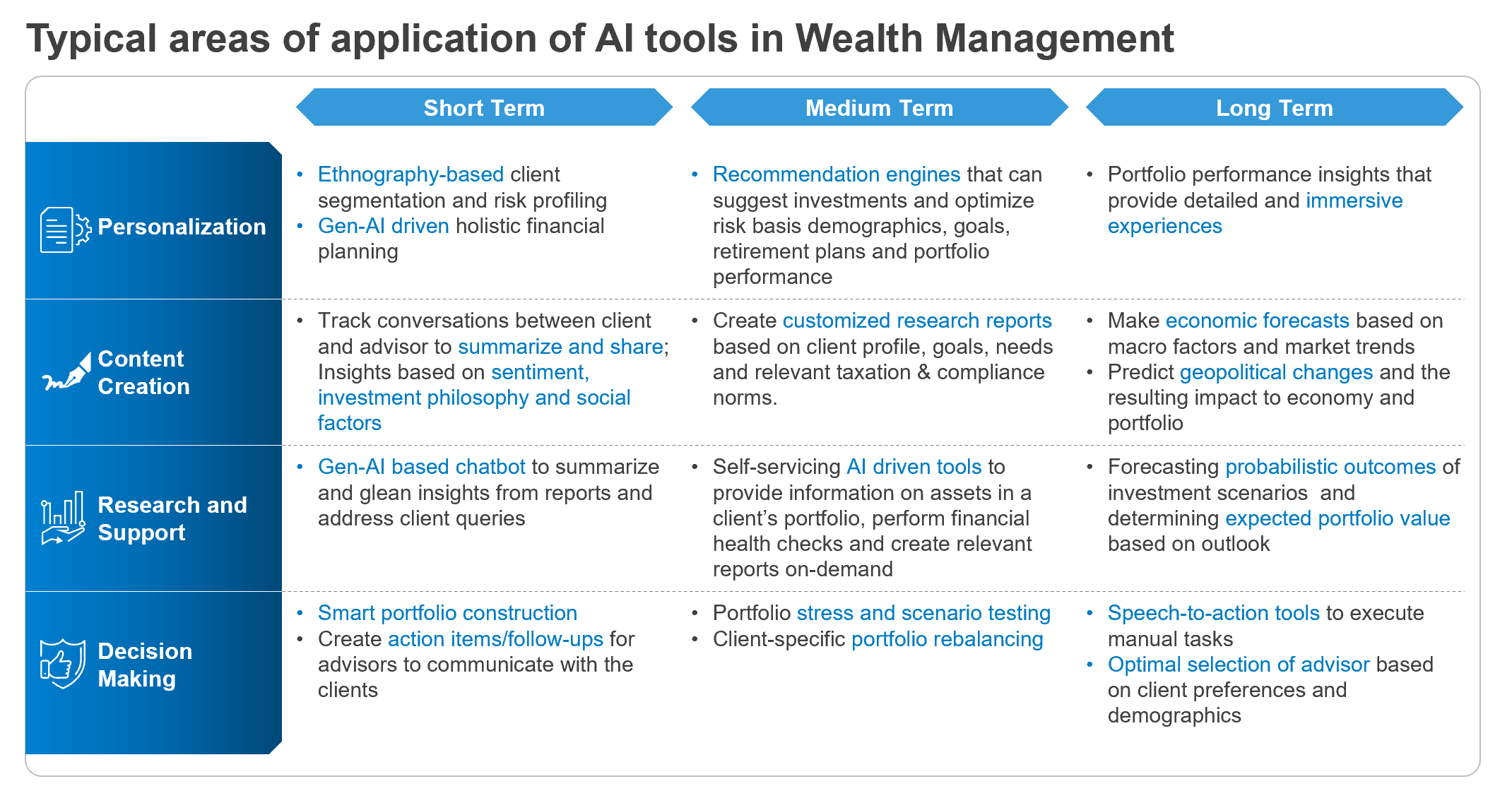

The foundational tenet of any AI-first enterprise is that AI should be applied across its business functions. Wealth management firms have started following structured methodologies to identify and deliver AI-driven use cases. The roadmap of use cases should account for multiple parameters such as AI themes (E.g., Personalization, Decision making), time to market (E.g., Short-term, Long-term), and business function readiness (E.g., Financial planning, Portfolio Management). Readiness can be measured as a combination of availability, maturity of the technology (E.g., Gen-AI, Speech-to-action) and ability to generate economies of scope and scale.

Figure 3 : Roadmap for application of AI in Wealth Management

Achieving scale while implementing AI models is trickier. Recent developments in commoditizing AI models have enabled firms to build enterprise analytics solutions that employ champion/challenger methodology[5] to identify the most effective model by comparing off-the-shelf, open source and internal models in real time. The models can be ranked and the champion among challengers can provide the roadmap for other models. These models will be strengthened by internal data, targeted metrics, human inputs, and other relevant parameters. But, at this point in time, it is difficult to reuse models built for one line of business in another unless the underlying parameters are similar (E.g., Models built to detect fraud in retail banking can be leveraged in commercial banking, but the same set of models cannot be reused in client servicing use cases).

New beginnings – Towards AI-first

There is a race to take advantage of AI. To stay ahead of competition, firms take a siloed view and adopt topical use cases that result in either sub-optimal implementation or at times total failure, thereby discouraging firms to take up any future initiatives. Several aspects must be factored in before implementing a specific use case. While there are quite a few conceptual ideas to leverage AI to a firm’s advantage, it is important to create an ecosystem that can seamlessly map these ideas to practical realities. These include business value proposition, client and employee impact, nature of legacy applications, availability of data, accuracy of models, adequate controls in the transformed business process and robust change management processes to ensure smooth adoption. The key to such imagineering lies in creating an AI-first enterprise.

As wealth management firms adopt these new-age technologies and tools, advisors will be able to serve a more eclectic mix of clients at a lower acquisition cost and higher margins. With traditional barriers such as geography and local knowledge breaking down, firms will become flexible, scalable, and globally accessible. A structured and targeted approach to embrace AI-first will empower advisors to spend greater time in human interactions to broaden the client base, increase efficiency, and generate higher returns.

Digital tools to open new doors – The Infosys Way

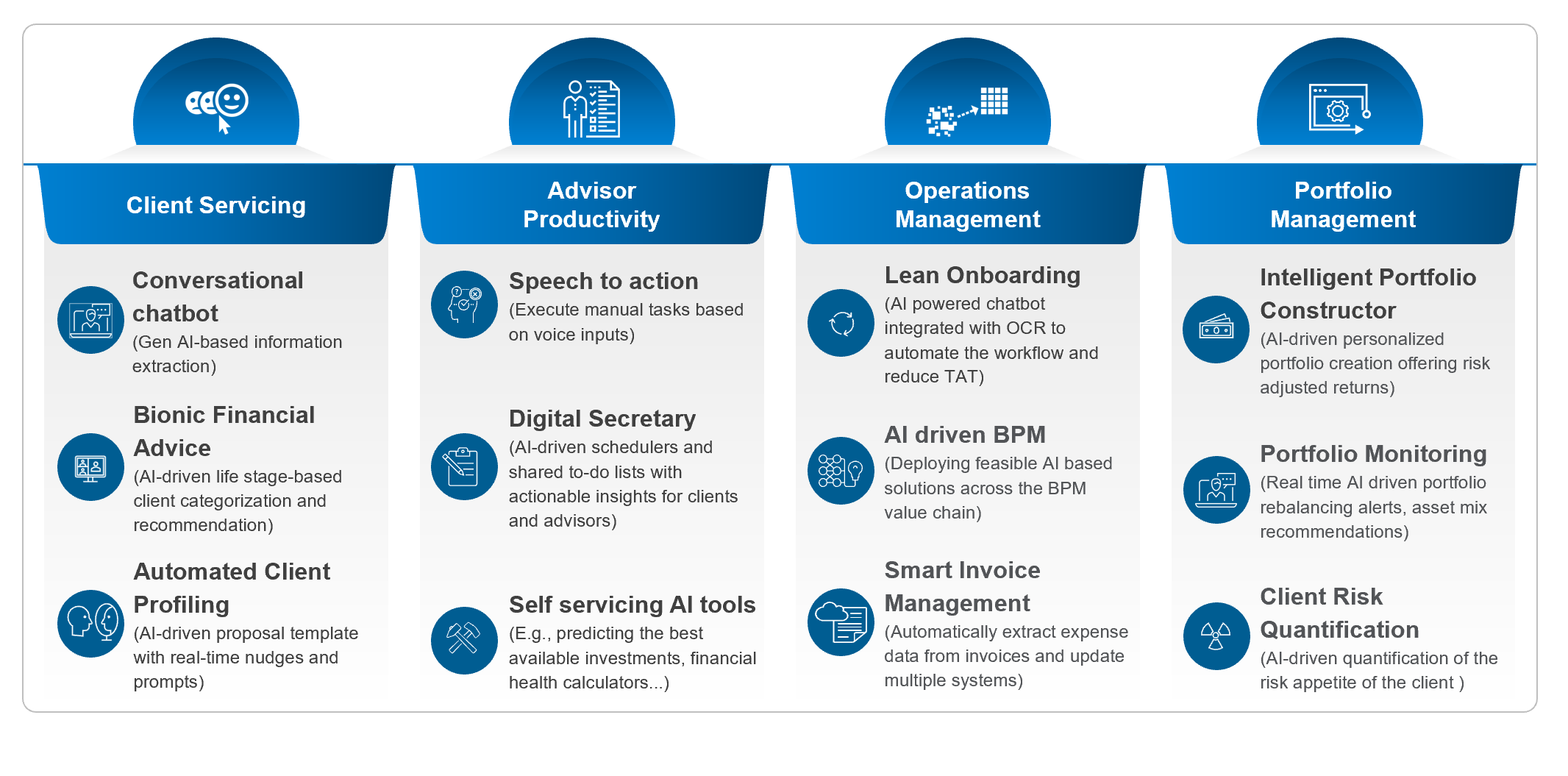

Infosys has leveraged technology to transform the businesses of our clients globally. We have identified and implemented AI-driven use cases for our clients across industries. There are a variety of AI driven use cases that we have implemented for our clients in the wealth management industry. To discover, define and deliver the use cases, please contact the authors below.

Figure 4 : AI Tools across the Wealth Management value chain