A payment gateway is a digital intermediary that facilitates the secure transfer of funds from a customer to a merchant. The payment gateway captures the data, checks the customer account and ensure funds are available and pays the merchant’s account.

Payment gateways are the digital conduits for accepting payments. In physical stores, they manifest as point-of-sale (POS) terminals that process card or smartphone payments. For online businesses, they serve as the virtual checkout where customers input credit card information or other payment credentials to complete purchases.

Payment gateway encrypts sensitive credit card details and ensures that information is passed securely during the payment transaction. The payment gateway works as the middleman between the customer and the merchant, ensuring the transaction is carried out securely and promptly.

Why Payment Gateway needed?

Payment gateways are very much required for the business which accepts online payments and credit card payments.

Online card payments are treated as a card not present transaction. During online payments, the customer’s card can’t be used physically like how it would be done in physical store’s POS terminal devices. So, the system (web/mobile application) depends on the card information entered by the user in the payments page. The problem is that system can’t verify/guarantee that the customer is using their own credit/debit card.

In the current world of internet hacking, when someone does online payment, the risk of doing fraud is very high. The hackers or fraudsters can access the banking information or card information easily from the portal if proper security measures not implemented. If this kind of financial sensitive data is compromised, it will the merchant’s business to the serious consequences.

Payment gateway encrypts the data during the payment transaction from portal to merchant’s account. It acts as a protection to the customer’s payment data. Payment gateway helps the customers to manage the chargeback(unauthorized or fraudulent payments) and fraud. The payment gateway providing critical information like closed accounts, exceeding credit limits, insufficient funds, and expired cards which will help the involved entities to take decisions on the next steps.

Payment Gateway – Behind the screens – How it works

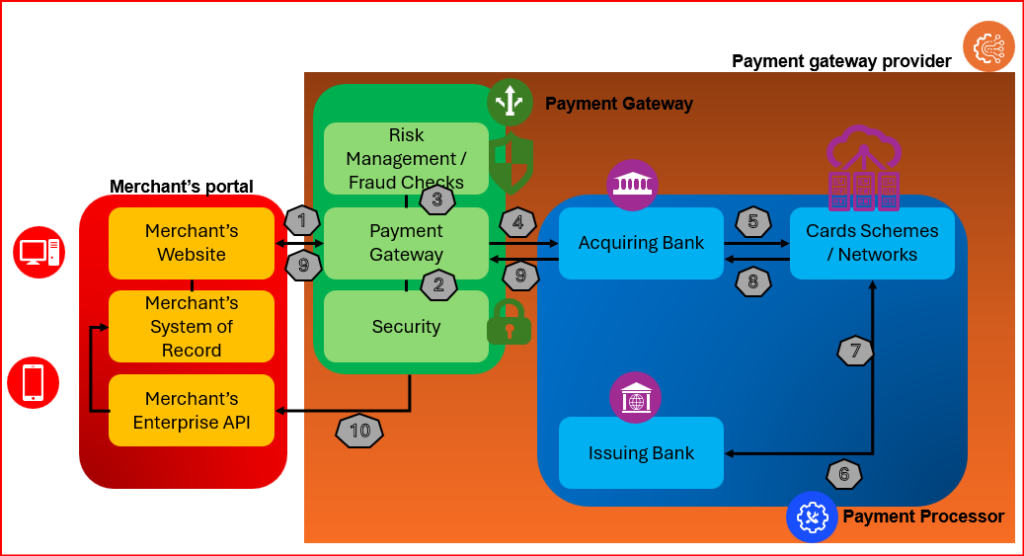

The payment page would be residing on the PGP (Payment Gateway Provider) website if the merchant chose the hosted payment gateway integration approach and the secured payment page provided by the PGP vendor would be residing on Merchant’s server if the merchant choses self-hosted payment gateway integration approach. The hosted payment page is the more secure way to collect payments from customers.

- After checkout, if the customer try to do payment by clicking “Pay/Submit Payment”, the user request would be redirect to the payment gateway provider website’s hosted payment page. The customer would provide debit/credit card details on the payment page.

- Payment gateways collect essential cardholder information, including name, expiration date, and CVV, and then securely encrypt it for protection.

- Payment gateways prioritize security by conducting fraud checks before transmitting encrypted card data to the acquiring bank.

- The payment gateway forwards encrypted payment data to the acquiring bank.

- The acquiring bank submits the payment transaction to the card network .

- The card Networks performs one rounder of security check for fraud and then sends the payment information to the issuing bank.

- The issuing bank accepts/declines the transaction based on the customer’s account status, Balance withdrawable amount, eligibility, card limit etc. and sends the response to Card Networks.

- The approved/decline message send to the acquiring bank by the Card Networks.

- The acquiring bank sends the approved/declined message to the payment gateway and then it sends to merchant’s website.

- The payment gateway would update the merchant’s System of record with transaction details via the enterprise API exposed by the merchant.

In case of approved transaction, the acquirer collects the transaction amount from Issuing bank and transfers find to the merchant’s business account. The transfer of funds between the issuer bank and the acquiring bank would take 1 day after the transaction. Expecting or assuming the risk of credit card transactions, the acquiring bank would wait 1 day to get paid from the issuer bank. The payment settlement would happen, and the transaction amount would be transferred to merchant’s business account. The transaction fee ( which received in addition to the transaction amount) would be posted in the PGP acquiring bank.

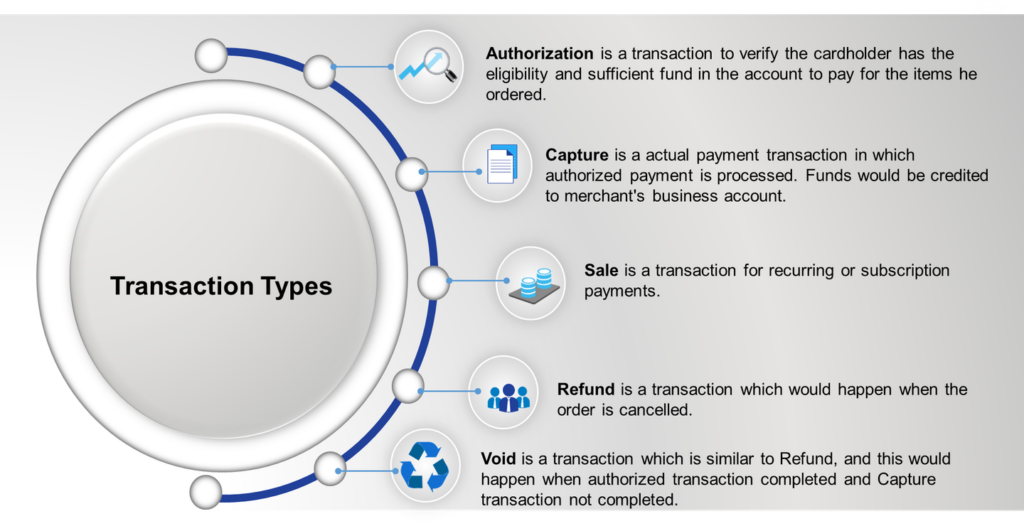

Payment Gateway – Transaction types

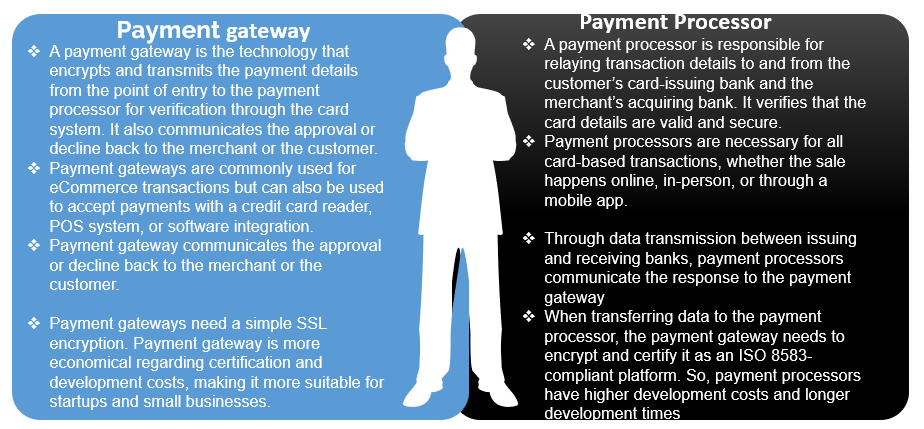

Comparison between Payment gateway and Payment Processor

Types of payment gateways

Businesses have a variety of payment gateway options to choose from, tailored to specific needs, preferences, and budget constraints. They are depicted in the below pic

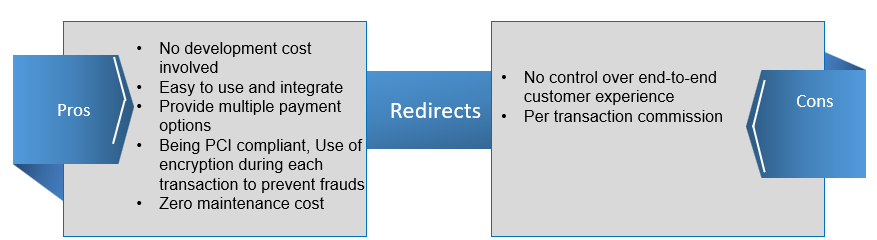

Hosted Payment Gateway (Redirects)

Hosted payment gateways(redirects) just redirecting the user payment request to another site (Payment service provider website) to process payment.

when a customer performs payment transaction by clicking the “Pay Now / Submit Payment /Buy Now” button on the merchant website, the merchant’s system redirects the customer’s request to the payment service provider’s website. The customer needs to provide his card or bank information. The card/bank account verification and payment transfer from customer account to merchant’s account would be performed by the PSP website in a smooth and secured manner. On transaction completion at PSP website, the customer would be redirected back to merchant’s site where the customer would see the order confirmation page or payment declined page based on the transaction details from PSP site response.

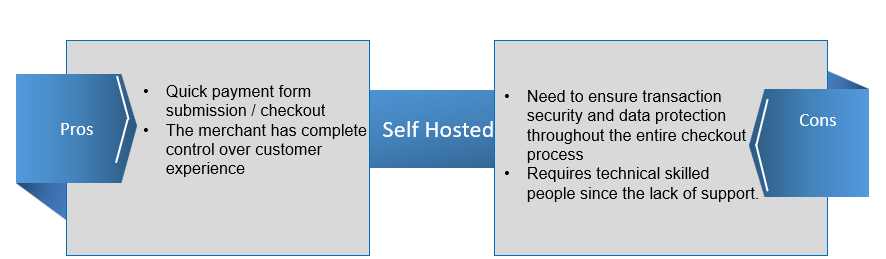

Self-Hosted Payment Gateway

The self-hosted payment gateway also known as pro-hosted payment gateways, in which the customer would provide credit/debit card details or bank account details on the merchant’s website. On submission, the data entered by the customer would be transmitted to the payment gateway’s URL for the payment completion.

The payment initiation only would be performed at merchant’s site, but final payment would be completed on a redirected PGP site. To some extend, the merchant website can go ahead with limited customization of the user experience.

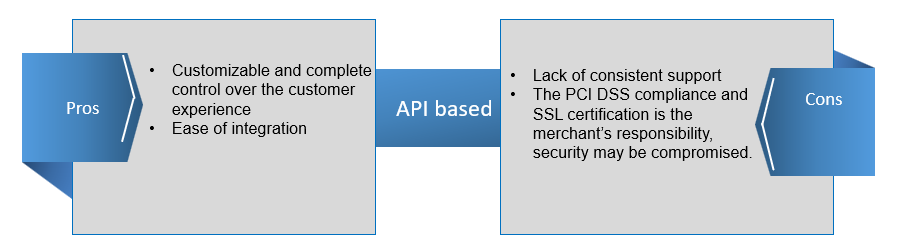

API based Payment Gateway

This is completely an onsite payment that means all the payment steps and processing would happen at the merchant’s application server. The design of checkout page which includes security, page loading time and customer experience would be handled by the merchant’s application development team only.

The customer would enter debit/credit card or bank account details on the merchant’s website in this API based mode. The payment processing would happen via HTTPS queries or APIs instead of redirecting to PGP URL. The merchants must possess SSL certification and DSS compliance.

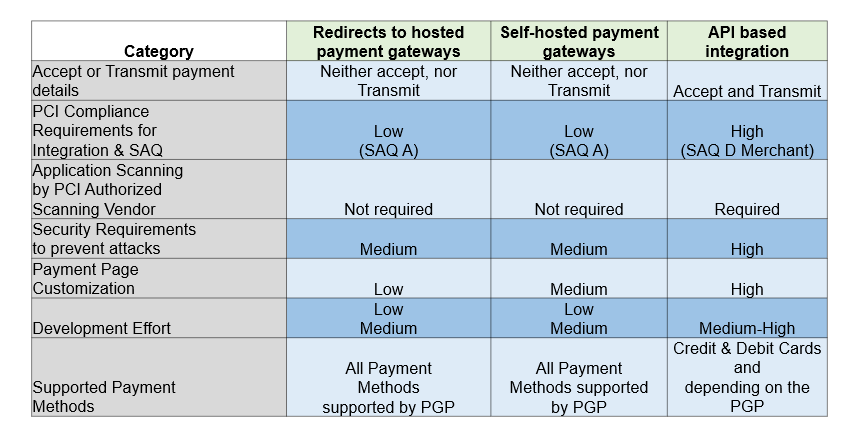

Comparison study between payment gateway types

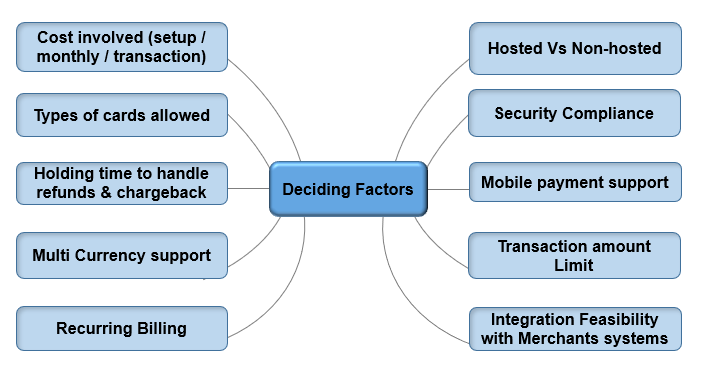

Deciding Factors in choosing right payment gateway

Recommended payment gateway integration

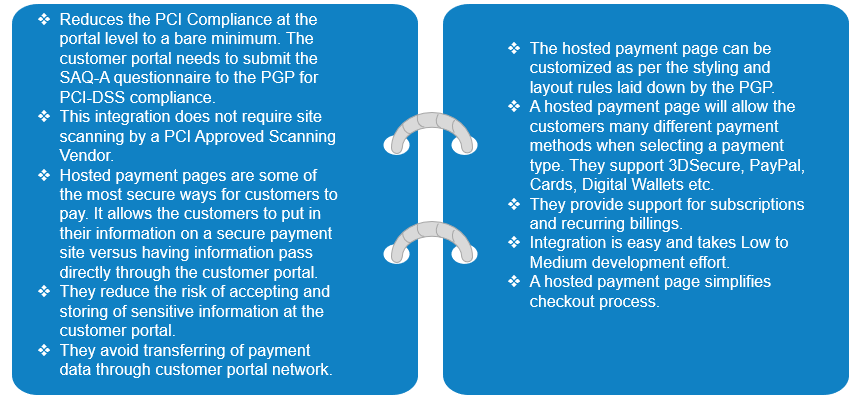

When it comes to Payment Page Integration, the Hosted payment gateway is the best among all the other integration modes. This option helps the customer portal in the following ways

In conclusion, hosted payment gateways emerge as the preferred choice for seamless and secure payment page integration. By offloading complex payment processing, merchants can concentrate on core business functions while benefiting from enhanced security, improved user experience, and reduced development costs. The flexibility and scalability offered by hosted gateways ensure businesses can adapt to evolving payment trends and customer expectations effectively.

Exception blog! Well-researched and informative content.

This is a well-explained and practical overview of how payment gateways function behind the scenes. The distinction between hosted and self-hosted integrations, along with the focus on security and fraud checks, is especially valuable for teams building payment-driven apps. Content like this helps businesses choose the right gateway with confidence. For those evaluating modern, scalable payment solutions, it’s worth exploring HitPay.