Across the globe, businesses keep facing constant challenges both within and outside such as customer behavior changes over the years, technological disruptions, dynamic geo-political situations, intense competition, financing difficulties, dynamic workforces and not to forget the global health pandemic which is the new addition in this list.

Mergers and Acquisition (M&A) is one of the key interventions that these global corporations adopt to cautiously navigate in tough business environments. A comprehensive and fully aligned IT and ERP strategy, that works cohesively with the underlying business strategy, becomes a key ingredient of the success of the M&A.

On a global scale, merger & acquisitions (M&As) have been growing over the years. Since 2000 close to 790000 transactions have been announced for close to 57 trillion USD. Between July 21 and 27, 2025, the global M&A market had 649 deals with a total value of 46.37 billion USD, out of which 23 transactions surpassed USD 500 million mark (TDV close to 36 billion USD) contributing close to 78% of the deal value of the week.

(Source: IMAA website).

This blog is an attempt to throw light on the key aspects pertaining to M&A/Demergers, how the alignment of the ERP strategy with overall M&A/Demerger objectives, had helped these corporations draw maximum benefit out of organizational consolidation transactions.

The typical objectives/drivers for M&A would be

- Gain access to new markets, geographic locations, consumer groups

- Achieve synergies through consolidation and collaboration

- Realize benefits through complementing (as opposed to competing) strengths

- Achieve non-linear increase in scale of operations and service delivery

- Pave way for entry to diversified industry segments

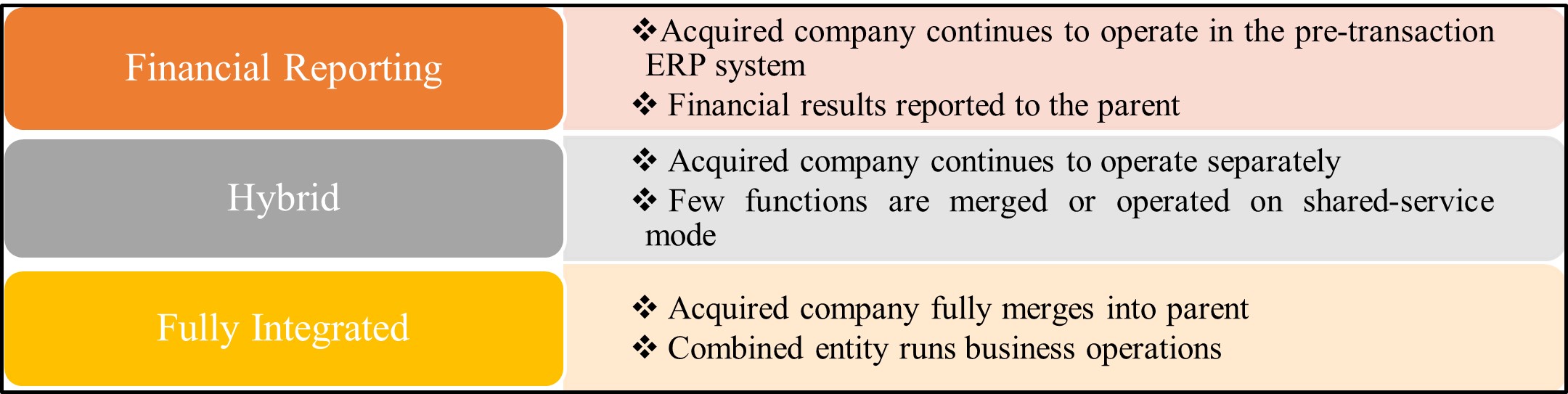

Over the years the business strategies after M&A/Demerger had been broadly classified into 3 types:

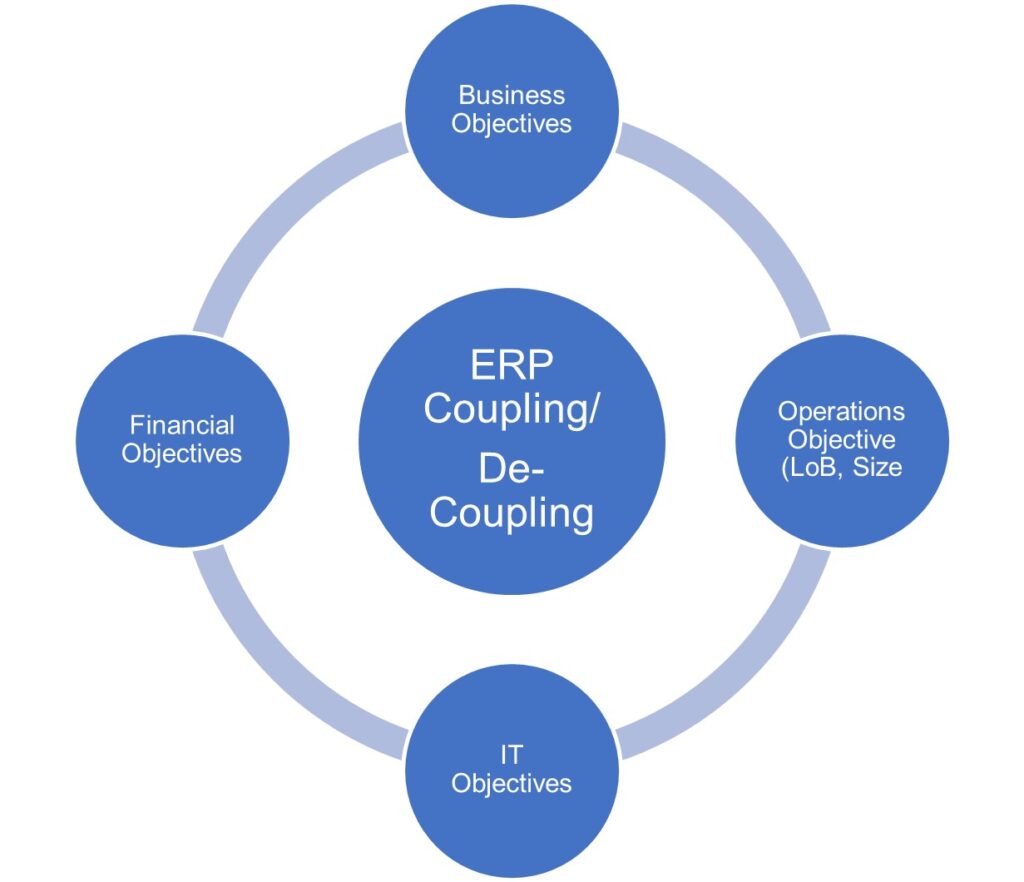

The success of the M&A/demerge largely lies on the right ERP strategies and correct coupling and decoupling approach taken up by these entities

ERP Strategies:

- Need varies for business to business

- Alignment to overall M&A/demerger objectives

- Depends on the Line of Business (LoB), size, type, industry operated etc

- Existing ERP status

- Existing ERP Product support availability horizon –Example a specific version may not be supported after a year or so.

- Risk appetite etc

Choosing the RIGHT ERP system, is the most important decision in M&A or demerger post-facto operations. It should align with the overall business strategy and with a clear risk and risk mitigation strategy analyzed for all possible scenarios.

Possible scenarios include:

- Acquired company adopting acquiring company’s ERP/merging entity adopting base entity’s ERP

- Acquiring company adopting acquired company’s ERP/base entity adopting merging entity’s ERP

- Retain existing ERPs, have common reporting platform as an add-on (Example – Hyperion or any BI Reporting Tool)

- Both moving to a new ERP system as applicable to Business (For example – If both are on the verge of Sunset with their legacy systems)

- Both on same ERPs – Simple, BUT YET NOT so simple – Still some synergies may be needed (Different processes, version etc)

At a more granular level it can be:

- Inventory org consolidation

- Operating unit consolidation

- Instance/Environment consolidation

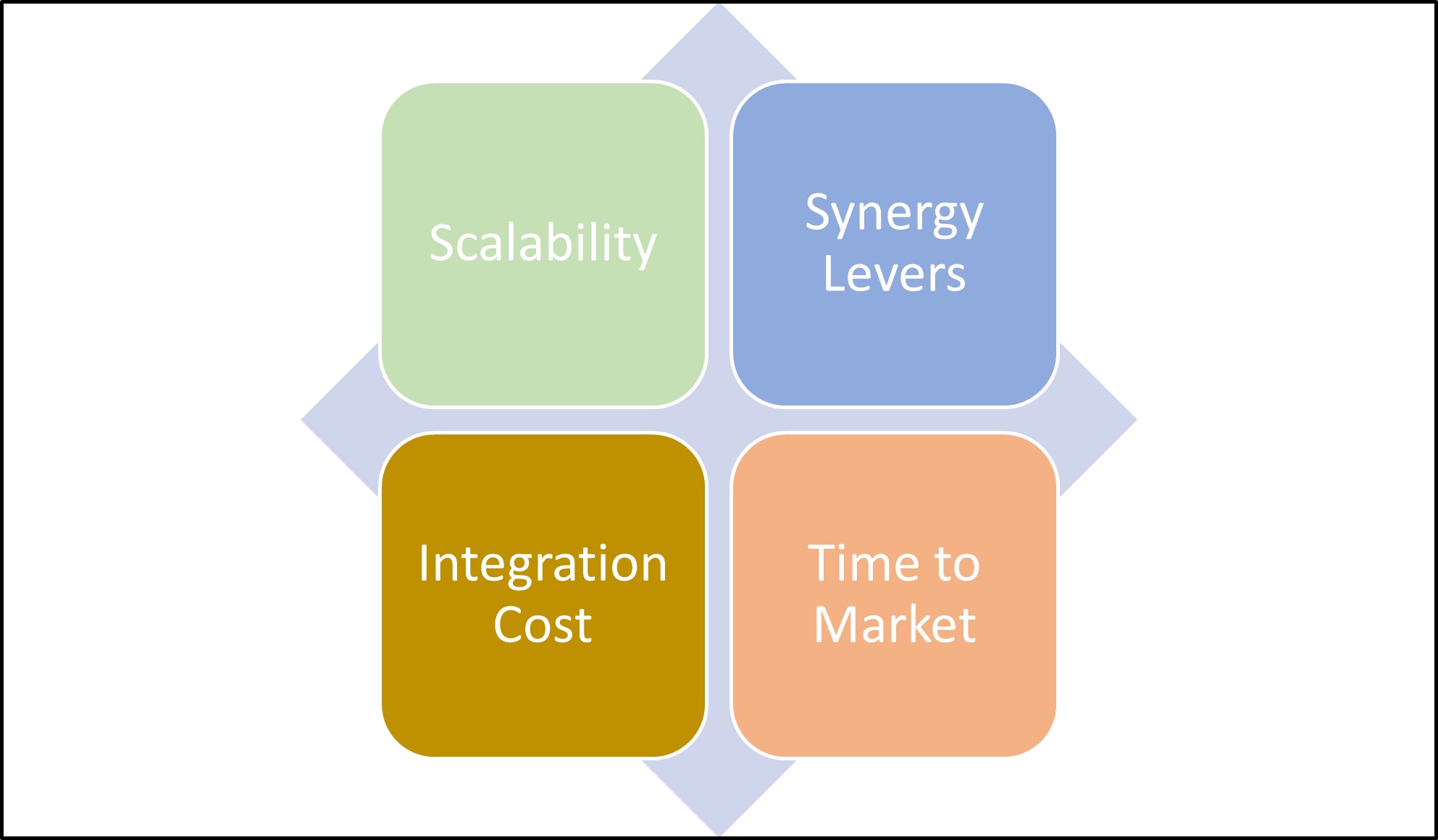

In case if the target application would be a NEW ERP, following key parameters can be considered in choosing the right one:

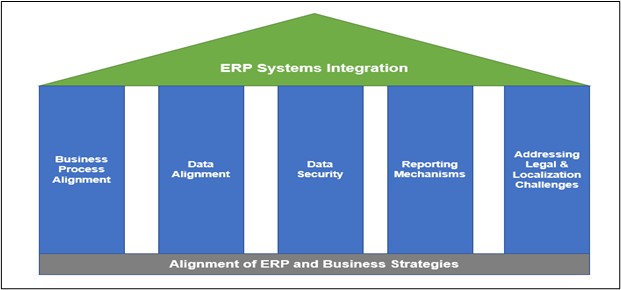

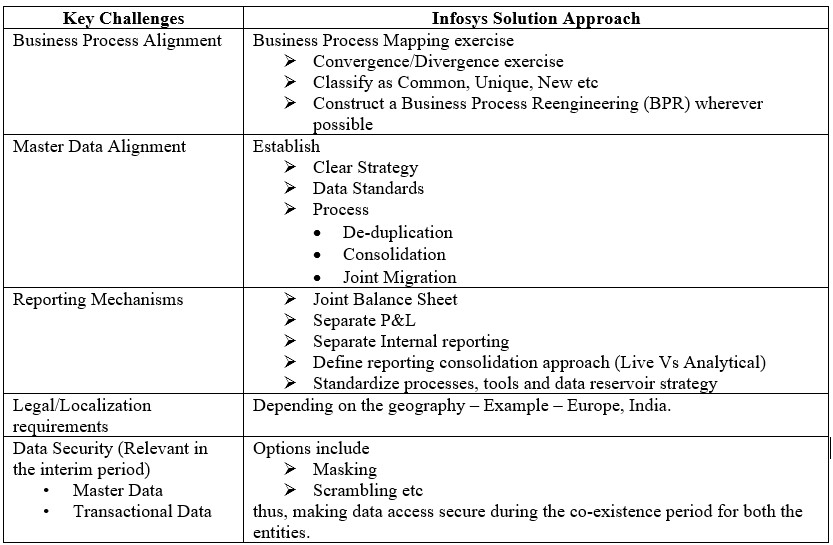

The typical challenges in the ERP Integration for M&A/Demerger could be classified into five main pillars.

Infosys solution framework/approach revolves around addressing the above key challenges. High-level framework is as given below:

Infosys has multiple tools and accelerators that can enable the smooth implementation of the ERP Strategies as part of the M&A/Demerger activities such as process review checklist dos and don’ts, comprehensive business process listing and flows, configuration questionnaire wizard, configuration documents, test scripts, which help the ERP implementation/rollout projects to be done in an accelerated deployment model.

Conclusion:

Dynamics and challenges associated with M&As have been very widely documented, discussed and there is a constant effort by organizations to make them successful. ERP systems integration is a key determinant of M&A success and Infosys, armed with depth of knowledge, learnings & experience gained through multiple engagements is strongly poised to advise and partner with organizations in this compelling strategic intervention.

Authors