The supply chain pipeline that used to bring trillions of dollars of goods worldwide is clogged, and there is no easy answer on how to unclog it. Cargo ships are waiting off major ports, unable to unload. Truckers are scarce and overstrained. Prominent rail yards have been clogged with trains backed up many miles unable to find space to unload.

Pandemic has fueled changing buying habits and an e-commerce boom, which also meant more cargo entering the U.S. than ever before. Once the dockworkers unload the containers, the lack of truckers, chassis, yard and warehouse space to store them is clogging the ports. If the ports don’t get unclogged, the arriving ships queue up in the ocean for weeks waiting to be docked. This volatility is compelling companies to place additional safety stock orders to avoid a stock out situation, which in turn is putting more stress on the supply network. In turn, consumers are facing a shortage of goods and a spike in prices due to the imbalance of supply and demand.

Transportation is a major driver of supply chain costs, and that cost is rapidly rising. Companies and policymakers need to quickly mitigate this with a combination of a short and long-term strategy.

Supply chain collaboration: For goods to move flawlessly from the overseas manufacturing plants to the consumers, the maritime fleets, shipping containers, cargo ports and terminals, truckers, chassis providers, railroads, and warehousing all must work in a synchronized manner. If any link in the whole chain gets interrupted, it causes disruptions for the entire supply chain. Different logistics firms, ports, warehouses, and stakeholders in the chain need to build strong collaboration to share resources, information, and technology. This requires having real-time supply chain freight visibility to help plan better for downstream chains. This necessitates collaborative investment in technology and data sharing and pave way for an integrated digital supply chain at the industry level.

The IoT technology using the cloud has been crucial in tracking real-time shipments and container management. A tool called port optimizer helps forecast there weeks of incoming cargo. The shipping industry collaboration needs to grow with investment in integrating data and technology, to involve ports, warehouses, and other stakeholders.

Strategize trucking optimally: Shortage of truckers and increase in demand for carriers has tested this industry. According to the “American Trucking Association,” there is an estimated shortage of almost 70,000 truck drivers. Supply chain strategizes need to get reconfigured keeping trucker scarcity as a key disruptor. This needs remediation at the policy-making and industry level. US government recently lowered the age limit to attract more pool of drivers. Policymakers also need to look at filling this gap by attracting drivers from beyond the borders or incentivizing certain aspects to fill this gap domestically. Some trucking companies shifted the focus on the operating fleet of smaller trucks where the driving license requirements are lenient and more pool of drivers available. The cost of this shift means more carbon footprint by operating more frequencies of smaller size fleets. Trucking companies have started investing in technologies to help optimize container management and fleet capacity.

Industries are looking at alternate ways to deal with this bottleneck like engaging 3PLs and finding alternate routes, ports, and suppliers closer to home. Another strategy companies are looking at is to move distribution and manufacturing facilities closer to each other and cut down on transit miles. The US supply chain needs to reduce its dependency on the trucking industry and look at investing in the railroad infrastructure to provide more direct links from the ports to the warehouses as a long-term solution. Evolving automation, especially self-driving technology can address the dependency on drivers, but it is still some years away.

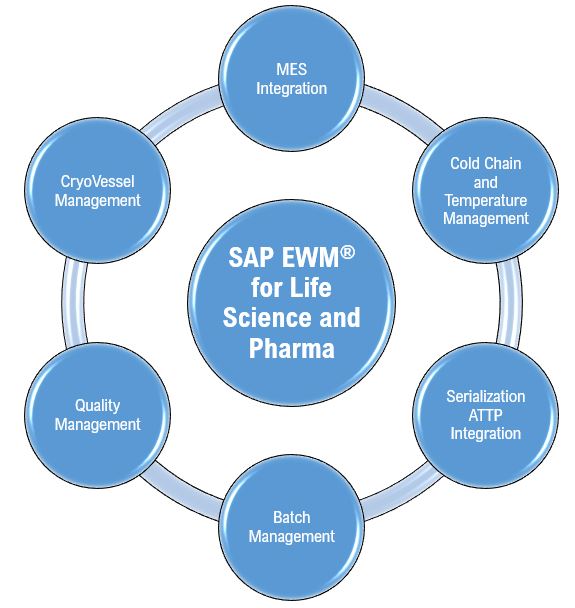

The logistical challenges in the supply chain are bringing out the broken gaps and opportunities to address them. There is a pressing need to digitalize and integrate the supply chain ecosystem with advanced data sharing and analytical capabilities. SAP product offerings like TM, Analytics on the cloud, and product footprint have been able to bridge some of these gaps along with integrating them with IoTs and blockchain technology.