Introduction

Post Pandemic, there has been a huge spike in the number of businesses going online. This has led to increasing demand of a tool to stream-line the entire business process, enabling enterprises to spend more time on the worldwide webs than with the customers.

An important aspect of such businesses today is the lead-to-Cash process, as this is the part which generates the actual revenue and keeps them going.

Salesforce’s Revenue cloud fits perfectly in this scenario, allowing businesses to track all their on-ground activities and giving them the wholesome picture which they always wanted.

Revenue cloud comprises of Salesforce CPQ and Salesforce Billing, where CPQ handles the quote and contract lifecycle management part, and Billing does the heavy lifting in revenue generation and management.

Salesforce Billing – Overview

Salesforce Billing comes as an Add-On package that can be installed in a Salesforce org and works in conjunction with Salesforce CPQ. It assists in collecting cash faster by unifying Sales and Finance with more complex billing data.

The package gives capability for invoicing an order and allowing its balances to be managed using payments and credits. This further helps as the customer payments can be automated using this and processed manually or using third-party payment gateways. Salesforce Billing also provides extensive reporting capabilities for Revenue recognition which then lets user account for revenue of a product provided to each customer.

Fig 1: Revenue Cloud – CPQ and Billing Integration

Revenue

When discussing about billing, it becomes imperative to talk a little about revenue flows, revenue recognition and what are the different jargons which complete the billing information for any firm.

We will use an example below to demonstrate how bookings flow to billings, cash and revenue.

Let us consider the following example where your company sells two types of plans – Plan 1 and Plan 2 to 4 different customers. Annual billing signifies that the customer pays the full amount for 1 year at the start, and monthly billing signifies that the customer will be paying only the month’s portion each month.

Fig 2: Example for Revenue flows: Scenario

For each month, company will be calculating the Bookings, Billings, Revenue, and the Cash flow.

Fig 3: Example for Revenue flows: Bookings, Billing, Revenue and Cash Flow

Bookings refer to contract’s value over time. Thus, representing the total amount business will make from the contract. When collated for all the contracts, this number will help business plan their future spends.

Billings refer to the actual amount which is billed to the customer on the invoice for a given billing duration. It tells the exact amount which the company will earn in each month.

Revenue is the income which the company generates after delivering the service to the customer. This keeps the company compliant with the Generally Accepted Accounting Principal rules.

Cash flow refers to the net amount of cash being transacted into and out of the company. It may be different from revenue if there is any delay or change in the invoices being paid by the customers. (In the example above, we have considered a situation where Customer A did not pay the amount for March but paid two invoices in April)

Fig 4: Quote-to-Cash

Revenue recognition helps companies determine how to account for the revenue and what all conditions need to be identified for the same.

As recognizing revenue can be different for a subscription product (sold over a long duration) and an asset product (sold one-time), hence an industry standard way has been created to allow for apples-to-apples comparison between different companies.

As per the defined industry principals, revenue can be recognized on the income statement in the period when realized and earned – not necessarily when cash is received. For ex: considering an annual order, revenue can be recognized during each of the 12 months, even though a single invoice might have been generated and paid for at the start of the term itself.

Enterprise Resource Planning

Any mid-size or large-size enterprise running today will have multiple facets to it, like accounting, procurement etc. Most of such companies use one or the other ERP system which helps them manage all these systems together.

When looking for integration between Salesforce CPQ and ERP systems, Salesforce Billing acts as a bridge by helping streamline the flow of data between the two systems, as it helps in translating CPQ’s data into a form which is easily readable by the ERP systems. Such data can then be leveraged by ERPs for all sorts of accounting and reporting.

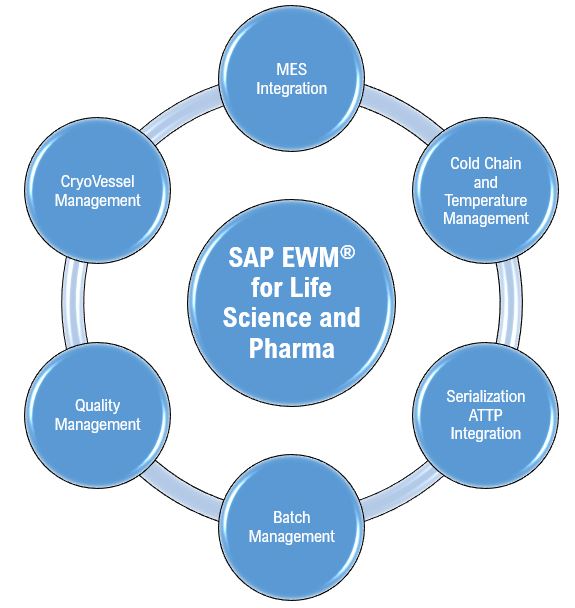

These integrations between Salesforce Billing and ERP systems can be classified into three types: Lead-to-Invoice, Lead-to-Cash and Revenue Recognition Reporting Integration.

Fig 5: Salesforce billing – ERP systems Integration touchpoints

As seen from the figure above, Salesforce CPQ will do the initial part of configuring the quote and creating order out of that. Post that, decision on when to integrate with ERP systems depend on the company’s legacy systems and their requirement out of the Salesforce packages.

Lead-to-Invoice allows CPQ and Billing to run as a single system, thus allowing to carry customer data from lead-to-invoice. This helps system to use the complex Billing scenario which can be handled within Salesforce Billing. The integration points for such a set-up would be Invoice and Invoice lines primarily. Once the information is sent further downstream, ERP systems can perform payments, adjustments, RevRec and financial reporting.

Lead-to-Cash works on top of lead-to-invoice which allows payments, collections, and adjustments within Salesforce itself. This works majorly towards bridging the existing Sales-to-finance gap, where every payment/credit/adjustment can be traced back to its source within the system.

Salesforce Billing provides capabilities for multiple types of product categories: Single Billing, Subscription based and usage-based products. This helps with the Revenue Recognition Reporting Integration as the package allows in defining custom revenue recognition periods for all the products. The custom recognition periods act a building block for managing complex revenue scenarios where the revenue needs to be split across several performance obligations.

The Billing package supports both order-based and billing-based reporting, where it lets user track revenue based on order product’s lifecycle or based on invoice line respectively.

Conclusion

Salesforce revenue cloud has provided a comprehensive solution in bringing each touchpoint in the Lead-to-Cash flow on a single platform. Further integrations with ERP systems help companies design the flow based on their needs, giving them the best of all the worlds. With increased reporting capabilities, it’s only the last mile delivery which needs to go outside the Salesforce ecosystem. Everything else, is very well structured.