In the 1990s, if someone told you that a square pattern of black and white dots designed to track car parts would eventually power a $16.8 billion global payment industry, you’d probably question their sanity. Yet here we are in 2025, watching Quick Response (QR) codes transform how the world conducts business, with projections showing growth in excess of $19.4 billion.

This isn’t just another tech trend. It’s a fundamental shift in how money moves around the globe.

Introduction: When Innovation Meets Necessity

The story begins with Denso Wave, a Toyota subsidiary facing a practical problem in the 1990s where the traditional barcodes couldn’t handle the complexity of automotive manufacturing data. They needed something that could store more information in less space while being easy to scan from any angle.

Their solution was a two-dimensional matrix barcode capable of holding up to 7,089 numeric characters – that’s nearly 2,400 times more data than a traditional barcode. They called it a Quick Response (QR) code, and it revolutionized inventory management across industries.

Fast-forward three decades, and this industrial tracking tool has become the backbone of digital commerce. The COVID-19 pandemic served as an unexpected catalyst, pushing businesses and consumers toward contactless solutions almost overnight. What started as a health necessity quickly revealed the superior convenience and efficiency of QR-based transactions.

Understanding the Technical Foundation

Modern QR codes in payment systems operate on sophisticated technical specifications that make them ideal for financial transactions. These codes can accommodate various data types: numeric characters (up to 7,089), alphanumeric combinations (up to 4,296), binary data (up to 2,953 bytes), and even complex character sets like Kanji (up to 1,817 characters).

This storage capacity enables QR codes to contain comprehensive payment information within a single scannable image. A typical payment QR code includes merchant identification numbers, payment network routing details, transaction amounts, security tokens, encryption keys, and timestamps for verification – all embedded in that familiar square pattern.

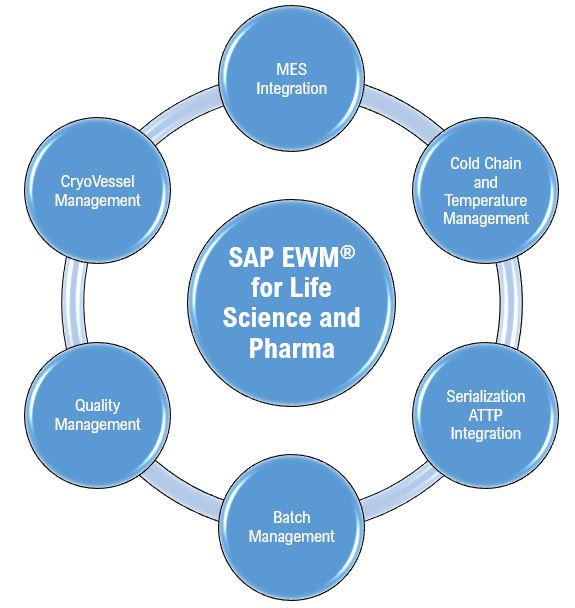

The real power lies in their versatility. QR codes seamlessly integrate with traditional banking infrastructure, digital wallets, point-of-sale terminals, e-commerce platforms, mobile payment applications, and loyalty program systems. This interoperability makes them a universal solution for both online and offline transactions.

The Numbers Tell a Remarkable Story

The growth trajectory of QR code payments reads like a startup’s dream pitch. Starting from a 2024 market valuation of approximately $16.8 billion, and reaching over $58 billion by 2034. This represents a compound annual growth rate (CAGR) of 13.2% over ten years.

Transaction volume statistics are equally impressive. QR code payment spending is expected to hit $3 trillion by 2025, marking a 25% increase from $2.4 trillion in 2022. User adoption follows the same upward trajectory, with over 2 billion users anticipated by 2025. Looking further ahead, global QR code transaction values could reach $8 trillion by 2029.

These aren’t just abstract numbers – they represent a fundamental shift in consumer behavior and business operations worldwide.

Regional Adoption: A Global Phenomenon with Local Flavors

The Asia-Pacific region continues to lead adoption, with Japan showing particularly impressive growth. Monthly active users jumped from 23.1 million in January 2020 to 80.9 million by June 2024. The Japanese market alone was valued at 9.46 trillion Yen in 2021, with projections indicating nearly double that figure in coming years.

China dominates the global landscape, expected to generate 85% of worldwide QR code payment transaction value by 2025, approximately $2.37 trillion. India has achieved remarkable growth, with QR codes now used in over 50% of all transactions as of 2025, primarily driven by the Unified Payments Interface (UPI) platform.

Meanwhile, Latin America is projected to surpass Europe in QR code usage by 2025, highlighting rapid adoption in emerging markets. The United States market, valued at $3.5 billion in 2024, continues steady growth, while Australia and New Zealand are experiencing momentum driven by post-COVID contactless habits and strong fintech-bank collaborations.

Market Segmentation: Solutions Lead the Way

The solution segment dominated the market in 2024, accounting for over 68% of total revenue share. This dominance reflects QR codes’ customizable nature – they can be tailored to specific business needs, including integration with existing Point of Sale systems, online stores, and customer relationship management platforms.

This flexibility has made QR codes particularly attractive to small and medium businesses that need cost-effective payment solutions without the complexity of traditional payment infrastructure.

What Makes This Growth Sustainable?

Unlike many tech trends that flame out after initial enthusiasm, QR code payments address fundamental pain points in traditional payment systems. They offer enhanced security through encryption and tokenisation, provide cost-effectiveness by reducing infrastructure requirements, ensure universal accessibility via smartphone compatibility, and support financial inclusion by enabling digital payments for underserved populations.

The technology’s ability to integrate with emerging innovations – artificial intelligence for fraud detection, blockchain for enhanced security, augmented reality for improved user experience, and Internet of Things for automated payments – positions it well for continued relevance as technology evolves.

Looking Ahead: Technical Models and User Experience

This remarkable growth story sets the stage for deeper exploration. The statistics and projections paint a clear picture of QR code payments’ trajectory, but understanding how these transactions work, from both technical and user perspectives, reveals why adoption continues accelerating.

In our next article, we’ll examine the specific benefits driving this adoption from both consumer and merchant perspectives, explore the security frameworks that make QR payments trustworthy, and analyze how this technology compares to traditional payment methods in real-world scenarios. We’ll also address the challenges organizations face when implementing QR payment systems and the strategic solutions that successful companies use to overcome these hurdles.